Tracking cotton from farm to retail shelves is no longer optional - it's a must. With increasing regulations like the U.S. Uyghur Forced Labor Prevention Act and the EU Green Claims Directive, brands are under pressure to verify the origin of every fiber. This ensures compliance, prevents forced labor concerns, and boosts accountability.

Key Takeaways:

- Traceability Methods: Includes taggants, forensic testing, and digital chain-of-custody systems (e.g., blockchain).

- Challenges: Cotton mixing during processing, supplier resistance, and fragmented supply chains.

- Solutions: DNA tagging, isotope analysis, blockchain, and digital platforms like the U.S. Cotton Trust Protocol.

- Regulatory Push: U.S. and EU laws demand detailed records, with detentions of non-compliant shipments rising by 25% in 2024.

- Future Trends: Digital Product Passports (DPPs) will soon let consumers scan garments to view their full production history.

Brands that prioritize traceability now will meet legal demands and build consumer trust. The tools are here - it's up to the industry to use them.

How DNA technology is being used to confirm the source of cotton

sbb-itb-0e617ca

Main Stages of Cotton Supply Chain Traceability

Cotton Supply Chain Traceability: From Farm to Retail

Cotton goes through several key stages before it reaches retail shelves. Each step presents its own set of challenges for ensuring traceability, which is critical for maintaining accountability.

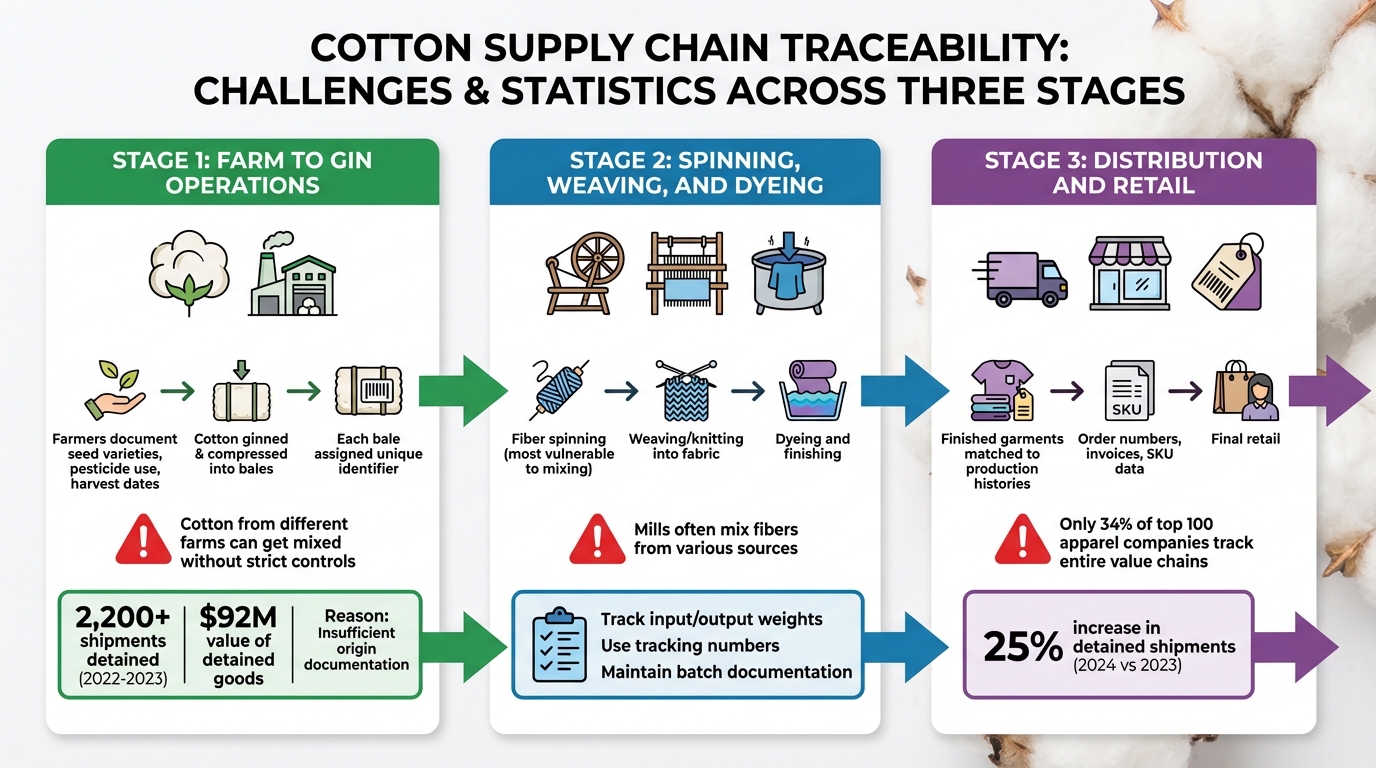

Farm to Gin Operations

Traceability starts at the farm, where farmers document essential details like seed varieties, pesticide applications, and harvest dates. Once harvested, cotton heads to ginning facilities, where the lint is separated from the seeds and compressed into bales. At this point, each bale is assigned a unique identifier that ties it back to the farm's records, laying the groundwork for tracking through the supply chain.

However, maintaining this transparency isn't always straightforward. Cotton from different farms can get mixed without strict controls, making it harder to trace its origins. For example, between 2022 and 2023, over 2,200 shipments of apparel and textiles - valued at nearly $92 million - were detained under the Uyghur Forced Labor Prevention Act due to insufficient documentation of origin.

Spinning, Weaving, and Dyeing

The spinning stage is particularly vulnerable to losing traceability, as mills often mix fibers from various sources. Without proper segregation or scientific markers, the original source of the cotton can disappear during processing. To counter this, mills track input and output weights, helping to spot any unauthorized blending or substitutions.

As the yarn progresses into fabric production - via weaving or knitting - and then undergoes dyeing and finishing, each facility must maintain a clear link to the previous batch. By comparing the weight of input yarn to the resulting fabric and using tracking numbers, manufacturers can connect each fabric roll back to its yarn source. This meticulous documentation is critical for ensuring that certified cotton, such as organic or sustainably grown varieties, retains its status throughout the process.

Distribution and Retail

In the final stage, finished garments are matched to their production histories through order numbers, invoices, and SKU data. However, only 34% of the top 100 apparel companies track their entire value chains, with most focusing solely on tier-one suppliers. This lack of comprehensive monitoring makes it difficult to verify claims about cotton origins or production practices. In fact, U.S. Customs and Border Protection reported a 25% rise in detained apparel shipments in 2024 compared to 2023.

Understanding these stages is essential for brands aiming to implement effective technology solutions to enhance traceability in their supply chains.

Technology Solutions for Cotton Traceability

Combining digital platforms, blockchain, and scientific techniques creates a robust system to track cotton across its production journey. These solutions address challenges at each stage, from data management to physical verification of cotton.

Digital Traceability Platforms

Digital platforms play a key role in managing cotton traceability from the farm to the final product. For instance, the Protocol Consumption Management Solution (PCMS), used by the U.S. Cotton Trust Protocol, tracks U.S. Cotton and Protocol Cotton through every step of production while monitoring six key environmental metrics. In the 2024/25 season, brands successfully tracked about 185,000 tons of Trust Protocol fiber using these digital tools.

These platforms often integrate advanced technologies like GPS-enabled tractors, drones, and sensors to capture real-time environmental data. Additionally, chain-of-custody platforms offer solutions for tracking mixed fibers, each with its own unique approach. When selecting a system, companies should request live demonstrations to ensure it effectively handles mixed fiber scenarios.

Beyond these platforms, blockchain technology adds an extra layer of reliability to traceability efforts.

Blockchain Technology for Permanent Records

Blockchain ensures a secure and unalterable record of every transaction and movement within the cotton supply chain. Platforms like VeChain and Credibl use distributed ledgers, providing a single trusted record accessible to all stakeholders. Smart contracts further enhance the process by automating verification, ensuring compliance and sustainability standards are met before transactions are completed.

A notable example comes from July 2021, when the UNECE launched a pilot project in Uzbekistan to trace T-shirts from cotton fields to retail shelves. This initiative involved Indorama Agro (farming), Indorama Kokand Textile (spinning), and Nil Granit (manufacturing), using an Ethereum-based blockchain and Haelixa DNA markers. The project successfully demonstrated end-to-end transparency in one of the world’s largest cotton-producing nations. By 2022, the UNECE global blockchain initiative had gained 68 pledges from 59 organizations, representing 253 partners worldwide.

For businesses to fully benefit from blockchain, adopting standardized data models like UN/CEFACT or ISO 19987 (EPCIS) is essential. These standards enable seamless integration with existing supply chain tools. Additionally, mobile-friendly interfaces are crucial to include small-scale farmers, allowing them to input field-level data through simple smartphone apps.

To complement these digital and blockchain solutions, scientific methods provide physical verification of cotton origins.

Scientific Methods for Cotton Verification

Scientific techniques offer a way to physically verify cotton origins, bolstering digital traceability efforts. One approach is DNA tagging, which uses synthetic, GMO-free markers applied to raw cotton during ginning. These markers withstand processing and can be tested later using PCR technology.

For example, PimaCott, a supplier of premium Pima cotton, collaborates with Applied DNA Sciences to add DNA markers during ginning in California's San Joaquin Valley. This system allows cotton to be scanned and identified throughout the supply chain, ensuring it isn’t mixed with lower-quality fibers.

Another method, stable isotope analysis, measures ratios of natural isotopes (like hydrogen, oxygen, and carbon) that reflect environmental conditions such as rainfall and soil composition. Similarly, trace element analysis examines the chemical makeup of fibers to confirm their geographic origin by comparing samples to a global reference database. These forensic methods are particularly effective for verifying geographic origin without altering the fiber. However, they come with challenges, including high costs and slower lab processing times.

To ensure reliability, companies should test whether these technologies remain effective after cotton is blended and confirm they can withstand rigorous textile treatments like dyeing, finishing, and laundering.

How to Implement Traceability Systems

To establish effective traceability in the cotton supply chain, it’s crucial to map the entire journey - from farm to finished product - using unique identifiers at every stage. This process involves identifying every step and intermediary in the supply chain and selecting a digital platform that connects key players like ginners, spinners, and retailers. Such platforms serve as a centralized system where all transactions can be recorded and verified. Given that cotton products typically change hands over seven times across three continents, this meticulous mapping is indispensable.

Every participant in the supply chain must adhere to transparency standards, such as the AbTF Transparency Standard, to maintain the integrity of the system. This includes providing training and support to suppliers to enhance digital literacy and ensure accurate data entry. For instance, in 2025, the U.S. Cotton Trust Protocol initiated pilot programs to recognize and trace regenerative practices among growers formally.

This detailed groundwork is essential for implementing specialized models like the Hard Identity Preserved (HIP) system, which ensures the integrity of certified cotton.

Hard Identity Preserved (HIP) Chain of Custody

The HIP model requires certified cotton to remain completely separate from non-certified cotton throughout every stage of the supply chain. This strict separation allows brands to confidently claim their products are "100% verified", rather than relying on percentage-based sustainability statements.

"True traceability means that a brand can verify exactly which cotton went into a specific product batch – not just claim that a certain percentage of their sourcing meets sustainability criteria." - Regenerative Cotton Standard

To implement HIP, businesses need dedicated storage facilities, separate processing equipment, and rigorous handling protocols. This approach not only satisfies regulatory requirements, such as country-of-origin labeling, but also supports brands in meeting new sustainability regulations like the EU Green Claims Directive.

While HIP offers robust traceability, putting it into practice can be challenging for many operators.

Common Challenges and Solutions

Fragmentation within the supply chain is a major obstacle to implementing traceability. Many transactions occur in informal work environments that are difficult to document, yet these links are essential for connecting smallholder farmers to broader markets. Addressing this requires targeted efforts to engage with fragmented supply chains and improve digital literacy among smallholders.

Another challenge is supplier resistance, often due to the additional administrative workload. This can be mitigated by highlighting the clear market advantages of verified practices. For example, a study by Wageningen University found that farmers cultivating Better Cotton in Nagpur earned 13% more than those growing conventional cotton, demonstrating the financial benefits of sustainable practices.

Standardizing data formats across the supply chain is another key step to ensure smooth information flow between intermediaries. Organizations like the Better Cotton Initiative offer global support teams to help suppliers transition from mass balance systems to physical traceability systems. Additionally, economic instability and fluctuating cotton prices can make suppliers hesitant to invest in new systems. To address this, a phased implementation approach can spread costs over time while showcasing value at each stage.

Regulatory and Environmental Aspects of Traceability

Meeting U.S. Regulatory Requirements

The Uyghur Forced Labor Prevention Act (UFLPA) assumes that goods produced entirely or partially in the Xinjiang Uyghur Autonomous Region, or by entities listed under the UFLPA, involve forced labor. As a result, these goods are prohibited from entering the U.S.. This poses a major challenge, especially since 85% of China's cotton originates from Xinjiang, accounting for 20% of the global cotton supply.

U.S. Customs and Border Protection (CBP) has made enforcing this regulation a priority. Over 60% of UFLPA detentions involve apparel and textile products. Even garments containing as little as 5% cotton sourced from restricted regions come under scrutiny. To counter this, businesses must provide detailed documentation tracing the cotton used in their products back to the farm or ginner, ensuring compliance with CBP requirements.

A case in point is QST Industries Inc., which revamped its supply chain in 2024 to cut ties with the Xinjiang Production and Construction Corporation (XPCC). QST introduced a "Purchase Order Compliance Addendum" for its Asian vendors and collaborated with a third-party audit firm to perform on-site Fiber Identification and Traceability audits. Their process meticulously maps the supply chain from the Cut-Make-Trim factory back to the yarn spinner, ginner, and farm. This digital audit trail ensures compliance with CBP's stringent standards. QST’s approach highlights how technology-driven traceability can safeguard supply chain transparency and compliance.

Supporting ESG and Environmental Goals

Traceability systems do more than meet legal obligations - they also support sustainability efforts and strengthen ESG commitments. The U.S. Cotton Trust Protocol is a prime example, offering farm-level data to back up environmental impact reporting. Results from Trust Protocol growers speak volumes: since 2015, soil erosion has decreased by 89%, and energy use intensity has remained 28% below the 2015 baseline. These growers have also met or surpassed five out of six 2025 National Goals aimed at environmental improvements.

"Transparency is no longer a nice-to-have, it's a need-to-have in today's operating environment." - U.S. Cotton Trust Protocol

Leading brands are tapping into these traceability systems to enhance their sustainability strategies. For instance, in June 2024, Carhartt, Inc. joined the U.S. Cotton Trust Protocol to gain access to verified cotton supply chain data. Similarly, in June 2025, KIABI, a European brand, adopted the Protocol Consumption Management Solution (PCMS) to integrate sustainability metrics into its fashion products. A month later, Engelbert Strauss, a German brand, followed suit, using the Protocol to strengthen its sustainable sourcing practices with verified transparency and environmental data tracking. These platforms also help brands align with the EU Corporate Sustainability Reporting Directive (CSRD) and the EU Green Claims Directive, ensuring certified cotton remains distinct from conventional fibers throughout the supply chain. This safeguards against greenwashing and reinforces trust in sustainability claims.

Conclusion: The Future of Cotton Traceability

The cotton industry is shifting gears - from voluntary transparency to mandatory verification. This change is largely driven by new regulations in the U.S. and EU, making traceability a must-have rather than a nice-to-have. The stakes are no joke: authorities have detained over 2,200 shipments of apparel and textiles, worth nearly $92 million, due to insufficient origin verification.

Technology is at the heart of this transformation. The move from mass balance models to Hard Identity Preserved (HIP) systems means certified cotton is kept separate throughout the supply chain. Tools like DNA tagging, stable isotope analysis, and digital platforms now offer forensic-level accuracy, creating a reliable trail from farm to finished product.

The numbers tell a compelling story. During the 2024/2025 season, the U.S. Cotton Trust Protocol's digital traceability platform helped 20 brands track 126,000 tons of cotton fiber across roughly 690 million finished products. That’s a staggering 413% growth in system adoption in just one year. It’s proof that large-scale traceability isn’t just possible - it’s happening.

What’s next? Traceability systems are evolving to enhance consumer engagement. For example, Digital Product Passports (DPPs) will allow shoppers to scan QR codes and instantly access a garment’s full history. For farmers, manufacturers, and retailers, these tools are no longer just about compliance - they’re becoming a competitive edge. Brands that embrace traceability now will be ready to meet both regulatory demands and consumer expectations. Research shows 70% of consumers care about ethical production, yet only 34% of the top 100 apparel companies currently track their full value chains. That’s a massive gap - and an opportunity.

The road ahead calls for teamwork. Ginners, spinners, and brands need to share costs and align their goals. Those who invest in traceability today will be better equipped for tomorrow’s challenges. By embedding these practices, the industry takes a strong step toward greater transparency and ethical production.

FAQs

Which traceability method fits my cotton products best?

The right traceability method hinges on what you're aiming for in terms of transparency, certification, and technology. If you need clear farm-to-product visibility, the U.S. Cotton Trust Protocol® is a strong option, ensuring both traceability and responsible sourcing. For those prioritizing organic practices, the Organic Content Standard (OCS) focuses on verifying organic certification. On the more advanced side, technologies like blockchain or DNA markers deliver precise tracking but can come with added complexity. The best choice will depend on your specific goals for certification, technology integration, and the depth of traceability you require.

How do brands prove UFLPA compliance with cotton records?

Brands maintain compliance with the UFLPA by implementing traceability systems that verify the origins of cotton and ensure it doesn’t come from restricted areas like Xinjiang. To achieve this, they rely on tools such as blockchain technology, DNA markers, isotope analysis, and detailed supply chain mapping. These methods help create a clear and accountable view of the supply chain, ensuring transparency at every step.

Can traceability still work when cotton is blended?

Tracing cotton’s origin becomes tricky when it’s blended, as pinpointing individual fibers gets much harder. While tools like physical tagging, forensic methods, and blockchain can assist in tracking, blending often dilutes the unique identifiers that make tracing possible. Advanced techniques, such as molecular tagging or stable isotope analysis, offer ways to trace origins even in blended cotton. However, these methods come with a hefty price tag. Blockchain, on the other hand, enhances transparency in the supply chain but depends heavily on accurate data input and collaboration across all parties involved.