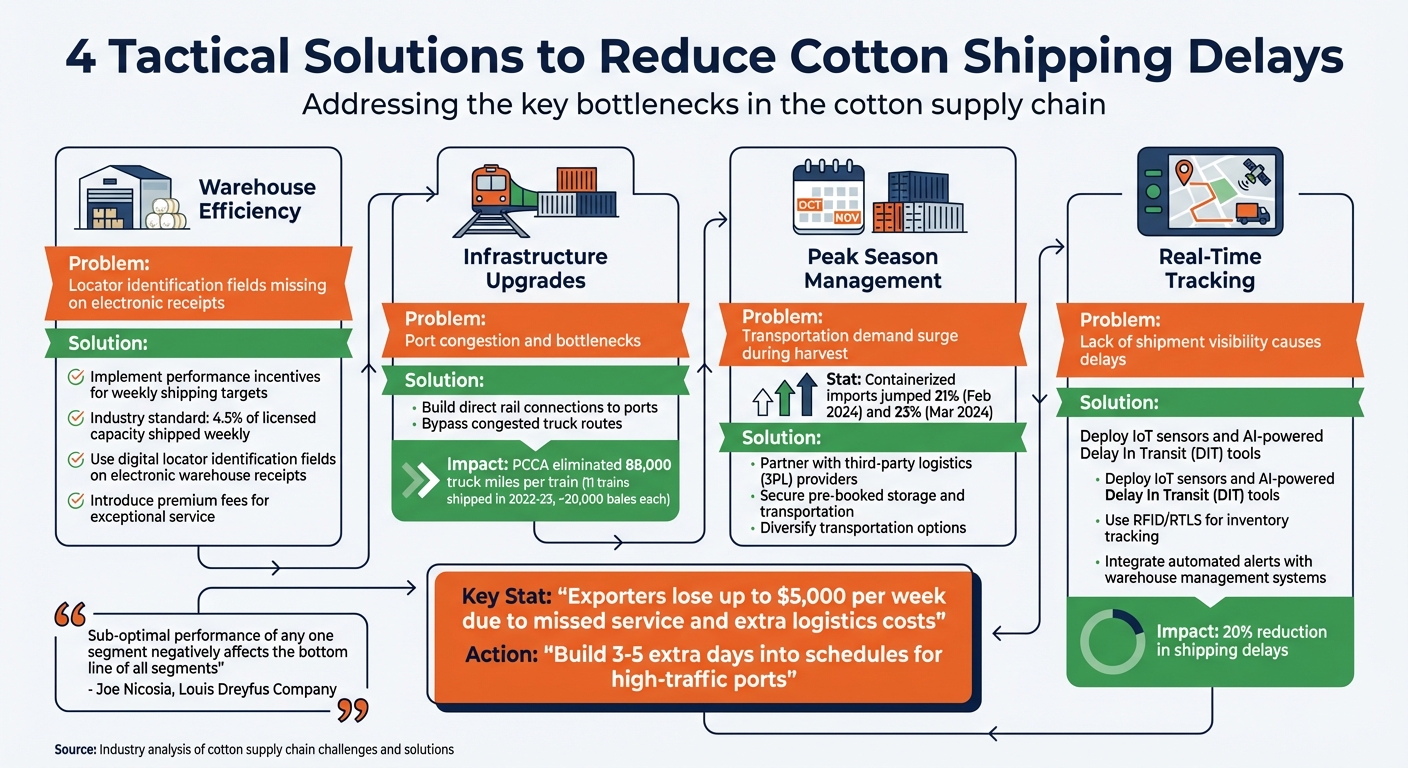

Cotton shipping delays disrupt the supply chain, costing businesses time and money. The key challenges include port congestion, warehouse inefficiencies, and geopolitical disruptions, such as rerouted vessels adding weeks to transit times. Here's how to address these issues:

- Warehouse inefficiencies: Improve operations with performance incentives and digital tracking tools like locator identification fields on electronic receipts.

- Port and infrastructure constraints: Invest in direct rail connections to ports and optimize routes to avoid bottlenecks.

- Seasonal transportation demand: Partner with third-party logistics providers to secure storage and transportation during peak harvests.

- Real-time tracking: Use IoT sensors and AI tools to monitor shipments and preempt delays.

Each segment of the cotton supply chain affects the overall outcome. Implementing these solutions can reduce delays, cut costs, and improve efficiency across the board.

4 Key Solutions to Reduce Cotton Shipping Delays

Shipping Cotton: Ocean & Inland transportation Shipping Solutions | MSC

sbb-itb-0e617ca

What Causes Cotton Shipping Delays

Cotton shipping delays stem from a mix of interconnected challenges. Pinpointing these issues is key to tackling them effectively.

High Transportation Demand During Peak Harvest Seasons

Harvest season brings a surge in demand for transportation, creating significant capacity issues. Exporters scramble to secure containers and vessel space, while importers, wary of labor strikes and geopolitical risks, often ship earlier than usual. For example, containerized imports to the U.S. jumped by 21% in February and 23% in March 2024.

Adding to the problem, inland equipment shortages disrupt the flow of goods. Fewer imports mean fewer empty containers at rail hubs, leaving freight mismatched with available equipment. Winter conditions further complicate matters, as rail providers like Canadian National (CN) and CPKC enforce safety measures - such as shorter train lengths and reduced speeds - that limit capacity and slow transit times. Ocean carriers also cancel sailings to adjust supply, creating additional headaches for agricultural exporters, who can lose up to $5,000 per week due to missed service and extra logistics costs. These challenges ripple through the supply chain, intensifying port congestion as vessels and containers vie for limited capacity.

Port Congestion and Infrastructure Limitations

Even though port operations have improved since the pandemic, infrastructure gaps still create bottlenecks. As of January 2026, major ports like Seattle-Tacoma, Long Beach, and Charleston operate well below the 85% congestion threshold, with utilization rates around 50–60%. However, specialized infrastructure remains a challenge. For instance, New York lacks certified fumigators for Brown Marmorated Stink Bug (BMSB) compliance, forcing shippers to reroute through ports like Philadelphia or Baltimore.

Regional differences also play a role. The U.S. Gulf Coast faces tighter capacity than the East Coast, as high resin export volumes compete for space needed by cotton exporters. Environmental factors, such as low water levels at ports like Montreal, can lead to surcharges and limit vessel operations. To navigate these hurdles, exporters often build an extra 3–5 days into their schedules when shipping through high-traffic ports. Beyond ports, inefficiencies at warehouses add another layer of delay.

Warehouse Operation Inefficiencies

Warehouse inefficiencies are another roadblock. A common issue is the failure to fill out "locator identification" fields on electronic warehouse receipts, which makes locating specific bales in large facilities a time-consuming task. The problem worsens during peak seasons, as warehouses juggle incoming cotton with the retrieval of older bales, slowing down operations overall.

"Warehouses serve as the storage and distribution centers and are responsible for making the product available to the customer. Their level of performance is critical to the overall success of the industry." - Joe Nicosia, Senior Head of Cotton and Merchandising Platforms, Louis Dreyfus Company

Complicating things further, carrier-related disruptions throw off warehouse planning. About 30% of some agricultural exporters' bookings are affected by shifting container receiving windows, leading to higher costs from increased staffing, container storage fees, chassis expenses, and detention and demurrage charges. Fixing these inefficiencies is vital for improving the cotton supply chain as a whole.

Practical Solutions to Reduce Cotton Shipping Delays

Tackling warehouse inefficiencies, enhancing tracking systems, and upgrading infrastructure can significantly cut down on shipping delays. These actionable steps provide immediate benefits for cotton producers and distributors.

Improving Warehouse Performance with Incentives

Incentives can help warehouses move cotton faster, especially during peak seasons. Dr. Gary Adams highlighted that offering credits for meeting weekly shipping targets can reduce future CCC loan costs. The industry expects warehouses to ship at least 4.5% of their licensed capacity weekly. However, during large harvests, even this minimum can be challenging. To maintain accountability, merchants can be charged for late arrivals, while warehouses face penalties for delays. Some facilities go a step further by introducing "premium fees" in their tariffs for exceptional service when shipping exceeds the minimum standards. Digital tools complement these efforts by reducing retrieval times and ensuring transparency.

Optimizing Cotton Tracking with Digital Tools

Once warehouses improve their performance, digital tracking can make shipping even smoother. A simple yet effective measure is requiring the "locator identification" field on electronic warehouse receipts (EWRs) to include specific bale location data. This detail speeds up retrieval, especially during busy periods when warehouses handle both incoming and outgoing inventory. The EWR "Batch 23" feature adds another layer of efficiency by letting shippers send specific request dates, which the USDA can audit for compliance. Platforms like CottonShipping simplify coordination by providing a centralized system where warehouses, shippers, and carriers can access shipping orders, scheduled load dates, and ready statuses in real-time. Since this tool integrates seamlessly with all eCotton warehouse systems without extra costs, it’s an accessible solution for the entire industry. Beyond digital tools, infrastructure improvements can address broader transit challenges.

Improving Road, Rail, and Port Infrastructure

Investing in infrastructure can dramatically reduce delays. For example, in November 2020, the Plains Cotton Cooperative Association (PCCA) launched a high-efficiency container loading project at its Altus, Oklahoma warehouse. Spearheaded by Jay Cowart, Vice President of Warehouse Operations, the initiative included building rail infrastructure to ship cotton directly to Los Angeles/Long Beach ports, bypassing the usual truck route to Alliance (Ft. Worth). By the 2022-23 fiscal year, PCCA had shipped 11 trains, each carrying about 20,000 bales, eliminating 88,000 truck miles per train.

"The train project gives cotton grown in our region a direct route to the ports on the U.S. West Coast and by extension, Asia. This improves the efficiency of the supply chain for our grower-owners' cotton." - Jay Cowart, Vice President of Warehouse Operations, PCCA

To make this possible, PCCA developed its own container tracking software to manage yard flow and hold staff accountable. This model of origin-based rail loading shows how direct access to ports can bypass congested hubs, cutting both transit times and costs.

Using Technology to Reduce Shipping Delays

Technology has become a game-changer in addressing operational challenges in cotton shipping. By providing real-time tracking and adaptable solutions, it helps minimize delays and ensures smoother distribution, especially during high-demand seasons.

Real-Time Tracking with Delay In Transit (DIT) Tools

Tools like IoT sensors and AI-powered systems now make it possible to track shipments in real time. These Delay In Transit (DIT) tools alert teams to potential disruptions - such as port congestion or severe weather - so they can reroute shipments proactively. Automated alerts alone have been shown to cut shipping delays by 20%, while also reducing detention fees, which are often caused by processing errors and account for 90% of such costs.

Digital tracking systems, using technologies like RFID or RTLS, create a detailed inventory "fingerprint", eliminating gaps in shipment visibility. For example, passive RFID tags, which don’t require batteries, allow for efficient scanning of containers. Cotton shipments, which are particularly sensitive to seasonal fluctuations, benefit from smart containers equipped with IoT sensors that monitor cargo conditions. These sensors can detect issues like moisture or improper handling that might compromise the quality of cotton bales during transit.

"Shipment delay alerts are not just operational tools; they are strategic assets that provide valuable data on vendor and carrier performance." - GoComet

By integrating automated notifications with warehouse management systems, consignees can receive shipment updates at least two days before delivery. This reduces missed delivery windows and keeps freight moving efficiently. Additionally, analyzing historical delay data helps shippers identify recurring bottlenecks, whether at specific ports or with certain carriers, enabling smarter decisions during future negotiations.

To complement these tracking systems, third-party logistics providers offer adaptable distribution solutions tailored to seasonal demands.

Third-Party Logistics (3PL) for Scalable Distribution

Third-party logistics (3PL) providers bring added flexibility to the table by offering warehousing and transportation networks that can adjust to the seasonal nature of cotton shipping. During peak harvest times, 3PLs secure pre-booked storage and offer diversified transportation options to handle the increased volume. This adaptability helps prevent crop spoilage and allows shippers to quickly pivot if a particular route or carrier faces staffing shortages or closures.

In addition to storage, 3PLs take care of complex customs documentation, such as commercial invoices and certificates of origin, which helps avoid delays and penalties at entry points. They also analyze shipping routes to find faster, more cost-effective options and use their established relationships with carriers to secure discounts for bulk shipments. Many 3PLs employ Transportation Management Systems (TMS) to provide real-time tracking, inventory updates, and proactive communication, keeping customers informed even during unexpected disruptions.

"As cotton crops depend heavily on temperature and weather conditions, production volumes can fluctuate greatly from season to season. That's why MSC specialises in scalable logistics solutions that can be adapted according to your production volumes." - MSC

Industry Resources and Partnerships for Cotton Shipping

Collaborations between cotton producers, gins, and logistics providers play a critical role in ensuring smooth transportation, especially during peak seasons. With the right tools and connections, these partnerships can significantly cut delays and boost profitability.

Connecting with Logistics Providers via cottongins.org

The cottongins.org directory is a go-to resource for connecting cotton producers and gin operators with trusted logistics partners across the U.S. This platform doesn’t just list cotton gin locations - it also bolsters industry networking through its "Member Web Sites" and "Related Organizations" sections. These features help users locate freight forwarders and carriers who are well-versed in the specific challenges of cotton shipping.

One standout tool on the site is the Cotton Module Transportation Calculator, developed by Texas A&M. It helps ginners calculate the most cost-effective transportation distances based on Percent Utilization (%U), ensuring that hauling costs don’t eat into profits. Additionally, cottongins.org provides essential shipping guidelines - like Flow-Shipment and Bale Packaging specifications - to help users avoid delays caused by non-compliance at warehouses and ports.

For businesses aiming to expand their reach, the site offers sponsorship opportunities. Starting at $200 per month, Official Sponsors gain benefits like logo placement and backlinks, while Featured Sponsors, at $400 per month, enjoy premium visibility, including two free sponsored posts annually. These sponsorships can be a direct line to influential players in the cotton supply chain.

Case Studies: Successful Cotton Shipping Practices

Real-world examples highlight how these partnerships lead to tangible improvements.

In April 2021, the Plains Cotton Cooperative Association (PCCA) teamed up with Burlington Northern Santa Fe Railway Company (BNSF) to launch a source-loaded container train project at its Altus, Oklahoma warehouse. This initiative, spearheaded by Jay Cowart (Vice President of Warehouse Operations) and CEO Kevin Brinkley, positioned Altus as one of only seven private intermodal match-back facilities in the BNSF network. By loading trains directly at the warehouse for transport to West Coast ports, PCCA eliminated the need for truck stops in Dallas, cutting 88,000 truck miles per train. During the 2022–23 fiscal year, PCCA successfully shipped 11 trains, each carrying roughly 20,000 bales of cotton.

"The train project gives cotton grown in our region a direct route to the ports on the U.S. West Coast and by extension, Asia. This improves the efficiency of exporting our grower-owners' cotton." - Jay Cowart, Vice President of Warehouse Operations, PCCA

To further optimize operations, Kelly Waller, PCCA’s Warehouse Administrative Manager, worked with the Information Systems department to create an in-house container tracking system. This software allows real-time monitoring of containers, improving loading efficiency and accountability.

Another success story comes from Delta Fresh, an agricultural exporter that, in February 2020, shifted from managing logistics internally to partnering with a specialized freight forwarder. At the time, the company faced a 33% late-delivery rate. The new partner introduced process standardization and phased technology integration, achieving a dramatic turnaround within a year. Shipping delays dropped by 73%, profits grew by 15%, and the damage/rejection rate fell from 8% to under 3%. This example underscores how professionalizing the supply chain through partnerships can prevent logistical issues that often cost exporters up to 15% of their potential earnings.

Conclusion

Shipping delays in the cotton industry don’t have to be a constant hurdle. By implementing strategies like warehouse performance incentives, digital tracking tools, and infrastructure upgrades, the movement of cotton can become far more efficient. As Joe Nicosia from Louis Dreyfus Company put it, "Sub-optimal performance of any one of the segments negatively affects the bottom line of all segments to some extent". Every small improvement has the potential to send positive ripples across the entire supply chain.

Leveraging technology can also give businesses a much-needed edge. Tools like scalable third-party logistics, real-time tracking systems, Transportation Management Systems (TMS), and electronic warehouse receipts with locator identification fields can significantly reduce retrieval times, improve visibility for decision-making, and help manage peak harvest volumes more effectively.

These advancements not only address current inefficiencies but also prepare the industry for future disruptions. Challenges like port congestion, blank sailings, and shifting trade policies remain a reality. Taking proactive measures - such as building buffer times into delivery schedules, securing bookings 2 to 4 weeks ahead during busy seasons, and diversifying port usage - can help mitigate these risks. These steps align with the practical solutions discussed earlier.

For those ready to take action, resources like cottongins.org offer valuable tools, including the Cotton Module Transportation Calculator and connections to reliable logistics providers, helping businesses turn these strategies into immediate results.

FAQs

How do digital tracking tools help streamline cotton shipping?

Digital tracking tools streamline cotton shipping by offering real-time shipment visibility throughout the supply chain. With these tools, stakeholders such as cotton gins, carriers, and exporters can keep tabs on shipment locations, monitor progress, and spot potential delays early. This eliminates the need for manual updates and fosters better communication.

In addition, these tools support faster decision-making by notifying users of issues like port congestion or transportation delays. This allows for quick adjustments to shipping plans, reducing disruptions. By enhancing transparency and coordination, digital tracking helps cut downtime, lower costs, and ensure cotton moves efficiently from farms to textile mills or export hubs.

How do third-party logistics providers help manage seasonal cotton shipping demands?

Third-party logistics (3PL) providers play a key role in managing the ups and downs of cotton shipping during seasonal peaks. They offer flexible solutions that help producers and distributors navigate fluctuating shipment volumes, ensuring operations stay on track and delays are kept to a minimum.

By using tools like advanced shipment planning, real-time tracking, and intermodal transportation (such as combining trucking and rail), 3PLs help avoid bottlenecks and keep deliveries moving efficiently. Their expertise, along with strong partnerships with shippers, boosts coordination and supply chain flexibility. This not only cuts costs but also ensures the cotton supply chain stays steady during periods of high demand.

How can investing in infrastructure help minimize cotton shipping delays?

Investing in transportation infrastructure plays a crucial role in cutting down cotton shipping delays. Improvements to major port facilities, like those at Los Angeles and Long Beach, can help alleviate congestion and speed up cargo handling processes. Expanding these ports' capacity ensures smoother operations and quicker turnaround times for shipments.

Upgrades to inland logistics hubs and intermodal facilities are equally important. Streamlining the transfer of goods between ships, trucks, and trains helps eliminate bottlenecks and keeps the supply chain moving efficiently. For example, enhancing rail systems can significantly reduce the need for long truck hauls, allowing cotton to move faster from farms to ports.

These targeted investments not only shorten shipping times but also strengthen the supply chain against disruptions, whether caused by weather or capacity constraints. Focusing on strategic improvements like these ensures a more dependable and cost-efficient shipping process for the cotton industry.