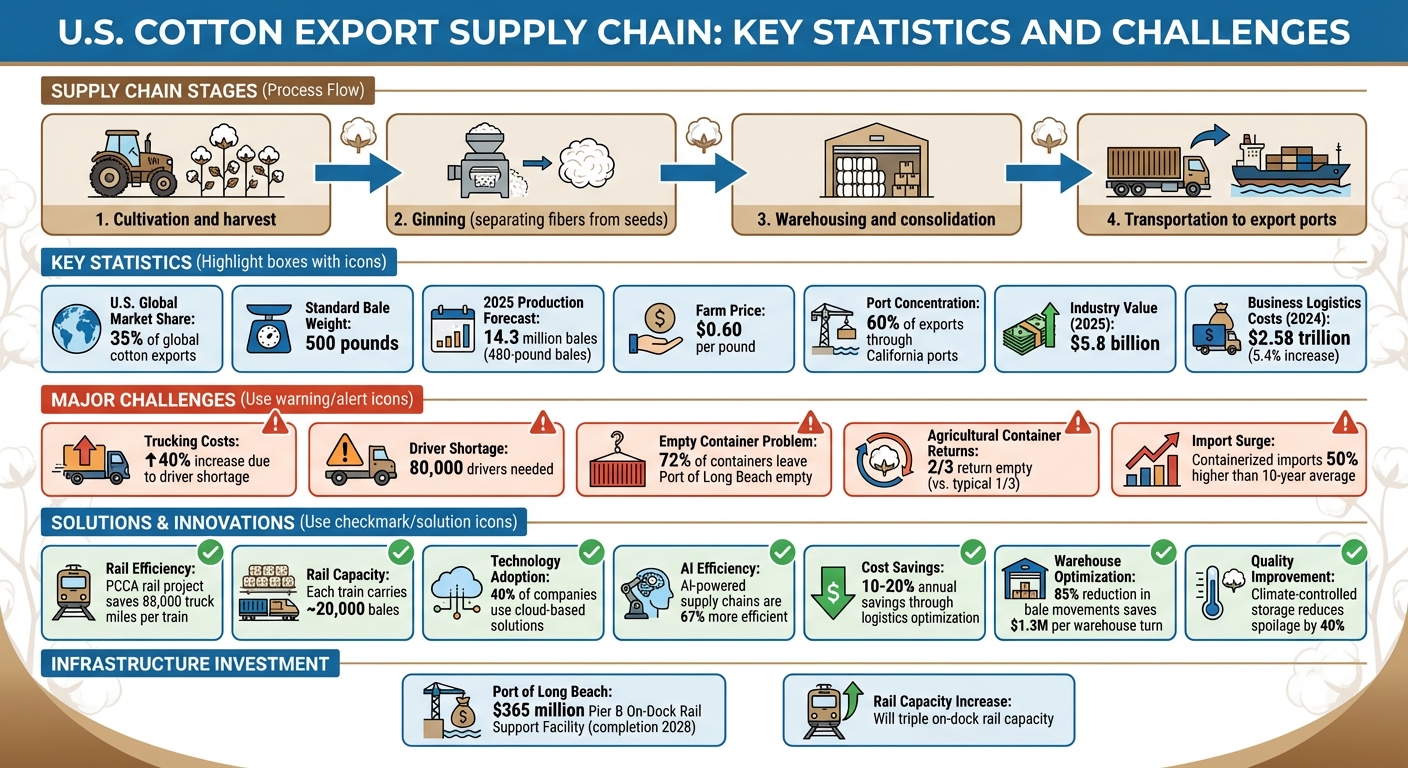

Moving U.S. cotton from farms to export ports requires precise logistics to maintain quality, control costs, and meet global demand. The U.S. leads in raw cotton exports, making up 35% of global shipments, but the process involves multiple steps and challenges. From cultivation to final transport, each stage must align perfectly to ensure efficiency.

Key Takeaways:

- Cotton Supply Chain Stages:

- Cultivation and harvest

- Ginning (separating fibers from seeds)

- Warehousing and consolidation

- Transportation to export ports

- Challenges:

- Rising trucking costs due to driver shortages (up 40%)

- Port congestion, especially in California

- Container shortages, with 72% leaving ports empty

- Solutions:

- Rail projects reducing truck mileage (e.g., PCCA's rail initiative saved 88,000 truck miles per train)

- Advanced tracking tools like IoT and blockchain for full supply chain visibility

- Optimized storage methods to protect fiber quality

- Compliance: Exporters must follow strict U.S. regulations like reporting through AES and meeting USDA quality standards.

Efficient logistics, supported by data and technology, is critical for U.S. cotton to remain globally competitive amid rising costs and supply chain disruptions.

U.S. Cotton Export Supply Chain: Key Statistics and Challenges

Baling and Short-Haul Transport After Ginning

How Cotton Baling Works

Once the ginning process is complete, cotton moves on to its final packaging stage: bale packaging. This step is crucial for protecting the quality of the ginned lint during both storage and transportation to textile mills. Cotton is compressed into tightly packed bales, making it easier to handle and store.

The process adheres to strict industry standards. Every bale covering, strap, and tie must meet the approval of the Joint Cotton Industry Bale Packaging Committee. These standards help maintain the cotton's fiber quality during transit. Additionally, controlling moisture levels is essential to prevent issues like mold or fiber deterioration during storage. This meticulous packaging process ensures the bales are ready for efficient transport to nearby warehouses.

Trucking Bales to Local Warehouses

After baling, the cotton enters the short-haul transport phase, where local trucking companies step in to move the bales to regional warehouses. This process emphasizes precision, safety, and thorough tracking. Specialized trucks equipped with breathable, secure containers are used to protect the cotton from moisture buildup and contamination during transit.

One example of efficient short-haul operations comes from Tigerhawk Logistics, which achieved over 99% on-time shipments while moving significant volumes of raw cotton across state lines to processing facilities.

"Dedication to the customer's needs is Tigerhawk first priority", said Grant Hortenstine, SIOR Vice President at CBRE.

Modern logistics companies rely on tracking technology to provide full visibility throughout the supply chain. Coordination teams carefully align schedules with harvest timelines and demand, while route optimization software reduces transit times and helps avoid delays caused by weather conditions. Safety is a top priority, with daily vehicle inspections, regular driver training, and weekly facility reviews ensuring shipments arrive in perfect condition. These short-haul operations play a key role in connecting on-farm processing with larger warehousing systems.

Warehousing and Consolidation for Export

Storage Methods That Protect Cotton Quality

After cotton bales make their way to regional warehouses, maintaining their fiber quality becomes a top priority. A standard cotton bale weighs about 500 pounds, so managing the storage environment is crucial. Proper ventilation, temperature control, and humidity monitoring are key to preventing moisture buildup and mold. Elevating bales on pallets helps protect them from ground moisture, while durable, water-resistant covers shield them from external elements. To keep the storage areas clean, warehouses avoid contaminants like pesticides and fertilizers. Many facilities use FIFO (First In, First Out) systems with clear labeling to ensure the cotton retains its quality over time.

Modern warehouses are also turning to advanced Warehouse Management Systems (WMS). These systems allow real-time tracking of inventory, including stock levels, locations, and movement patterns, making operations more efficient.

"A lot of companies are maximizing their vertical space by implementing automated storage and retrieval systems, allowing them to save space and expand operations in their current building without the need for relocation. It's a win-win situation that overcomes space constraints while boosting productivity."

– Mark Dunaway, President - Americas, Kardex Remstar

This careful approach to storage ensures that the cotton is in excellent condition when it’s time for consolidation at central hubs.

Major Consolidation Hubs in the U.S.

Once cotton bales are stored under optimal conditions, the focus shifts to efficient consolidation for export. Strategic hubs play a vital role in moving cotton from regional warehouses to export ports. Dallas, Texas, stands out as a premier consolidation center, thanks to its exceptional transportation network. From Dallas, carriers can reach 93% of the U.S. population within two days and up to 95% with additional strategic sites. Its extensive highway and rail systems, paired with a skilled workforce, make it a hub for large-scale cotton consolidation.

U.S. cotton warehouses also adhere to BMAS mandatory reporting requirements, which help improve efficiency and reduce costs. In 2025, the National Cotton Council (NCC) and the USDA introduced the 4-Bale Module Averaging Pilot Program. This voluntary initiative uses modern techniques to enhance bale fungibility, improving warehouse operations and overall quality. Additionally, tools like electronic warehouse receipts (EWR) simplify logistics. For example, EWR, Inc.'s "Update Shipping Order Feature" streamlines shipping date coordination from Memphis-based operations. USDA-APHIS also supports the process with its "cotton friendly" phytosanitary certificates, ensuring smooth regulatory compliance for exports.

These advanced storage and consolidation practices work together to ensure timely, efficient, and high-quality cotton exports.

What Is The Role Of The Cotton Warehouse? - The World of Agriculture

Transportation Methods to Export Ports

After consolidation, moving cotton efficiently from hubs to export ports is vital to maintain its quality and keep costs under control.

Trucking for Domestic and Border Shipments

Trucking plays a key role in transporting cotton bales from consolidation hubs to ports and mills. However, the industry is currently grappling with a massive driver shortage - around 80,000 drivers are needed. Buddy Allen, President and CEO of the American Cotton Shippers Association, highlights the issue:

"The supply chain challenge is real, and we're not executing well".

This shortage has driven up trucking costs by nearly 40%. Flatbed trucks are often used to haul uncovered bales, while containerized loads are preferred for longer journeys to better protect the cotton. Despite its importance, trucking faces stiff competition from rail transport, which offers a more cost-effective solution, reduces road congestion, and often shortens transit times.

Rail Transport to Major Export Ports

Rail transport has emerged as a practical alternative for long-haul shipments. For example, the Plains Cotton Cooperative Association (PCCA) launched a rail project in November 2020 at its Altus, Oklahoma warehouse. This initiative allows cotton to be loaded directly onto trains for transport to West Coast ports like Los Angeles and Long Beach. Each train eliminates over 88,000 truck miles and carries about 20,000 bales. During the 2022–23 fiscal year, PCCA shipped 11 trains from this facility. Jay Cowart, Vice President of Warehouse Operations at PCCA, explains the benefits:

"The train project gives cotton grown in our region a direct route to the ports on the U.S. West Coast and by extension, Asia. This improves the efficiency of the supply chain for our grower-owners' cotton".

Additionally, major ports are investing heavily in rail infrastructure. For instance, the Port of Long Beach is building the $365 million Pier B On-Dock Rail Support Facility, scheduled for completion in 2028. This project will triple the port’s on-dock rail capacity and allow it to handle trains up to 10,000 feet long.

Port Handling and Ocean Shipping

Once cotton reaches export ports, efficient handling becomes critical, though significant challenges remain. Around 60% of U.S. cotton exports pass through California ports, where ongoing congestion adds costs and delays. A severe container shortage compounds the problem - 72% of containers leave the Port of Long Beach empty. For agricultural exports, specifically, two-thirds of containers return empty, compared to the typical rate of one-third. This issue stems from shipping companies prioritizing the quick return of empty containers to Asia, where they can fetch higher profits from imports. As a result, cotton exporters face higher costs and difficulty securing containers.

Adding to the strain, containerized imports to the United States are running about 50% higher than the 10-year average, overwhelming port capacity and causing delays. Buddy Allen sums up the situation:

"The most simplistic metric to explain the supply chain gridlock is that total inbounds cargo over the last two years has been twice the normal level. We are continuing to inundate our supply chain with more cargo than it is physically able to handle. This challenge is real. We have no idea when this will be over, but there is no real indicator of significant relief on the horizon that we see".

These logistical hurdles and rising costs are making U.S. cotton less competitive compared to global players like Brazil.

sbb-itb-0e617ca

Regulatory Compliance and Quality Handling

Navigating regulatory compliance and maintaining quality control are essential steps in protecting the market value of cotton exports.

Understanding Regulatory Requirements

For cotton shipments exceeding $2,500, exporters must use the Automated Export System (AES) to report shipment details to the U.S. Census Bureau. Before shipping, confirm whether your product requires an Export Control Classification Number (ECCN) and review the Consolidated Screening List to identify any buyer restrictions. These processes are governed by the Export Administration Regulations, managed by the U.S. Department of Commerce's Bureau of Industry and Security.

Another layer of complexity comes with advance manifest requirements. Exporters must provide 16 critical data points - like shipper and buyer details, sailing schedules, commodity descriptions, and container seal numbers - to both the U.S. Census Bureau and their carrier before loading. Cotton shipments also need to be classified using Harmonized System (HS) codes, which determine duties and confirm the product's origin. If the shipment qualifies for trade agreements like USMCA, it’s crucial to verify the bill of materials and supplier origins early to benefit from duty reductions.

Additionally, compliance with truck and container weight limits set by the Department of Transportation is vital to avoid penalties and delays. The Plains Cotton Cooperative Association’s Traffic and Invoicing Department, with 90 years of combined expertise among its seven team members, oversees these intricate processes for exports to 10 to 15 countries each season. Their busiest period typically spans November through April.

Once compliance is addressed, the focus shifts to ensuring cotton quality during transit.

How to Preserve Cotton Quality During Transit

Maintaining cotton quality during transport is just as important as meeting regulatory standards. One key factor is controlling moisture levels. Cotton should have a moisture content of 7.5% or less to prevent fiber deterioration. Excess moisture - especially from liquid sprays - can weaken fibers and diminish market value. The USDA enforces quality standards under the United States Cotton Standards Act, which defines benchmarks for color, leaf content, staple length, and other fiber properties.

Preventing contamination is another critical step. Starting July 1, 2018, the USDA Agricultural Marketing Service introduced new extraneous matter codes to address plastic contamination, responding to industry concerns. Proper module covers and careful handling practices can help avoid lint contamination. During transport, using secure, breathable containers minimizes moisture buildup and shields cotton from external contaminants.

Climate-controlled storage offers additional protection. For example, a processing plant equipped with advanced climate controls and real-time monitoring successfully reduced product spoilage by 40%. By maintaining ideal temperature and humidity levels, coupled with regular quality checks, the facility ensured its cotton was ready for market delivery. On a larger scale, specialized vehicles with proper ventilation and optimized route planning have enabled one major producer to achieve a 99% on-time delivery rate without compromising quality.

Reducing Costs and Tracking Shipments

Managing logistics costs efficiently requires a mix of smart planning and advanced tracking tools. In 2024, U.S. business logistics costs hit $2.58 trillion, reflecting a 5.4% rise compared to the previous year. For cotton exporters, even small boosts in efficiency can lead to big savings. On average, companies save 10 to 20 percent annually by refining logistics processes, all while improving delivery reliability. Here’s a breakdown of strategies and technologies that help cut costs and improve shipment tracking.

Smarter Transport Planning

One key to reducing costs lies in limiting bale handling at warehouses. Every time a bale is moved, costs go up. By allowing a 5% quality tolerance for bale substitution, companies can reduce movements by over 85%, saving approximately $1.3 million per warehouse turn.

Choosing the right transportation mode also plays a major role. Switching truckload shipments to intermodal transport or consolidating smaller loads can result in savings of 5–20%. For long-distance shipments to major export ports, rail often proves more economical than relying solely on trucks.

A Transportation Management System (TMS) can further optimize logistics by refining routes and carrier selection, yielding 2–5% savings. Strategic sourcing adds another 3–15% in savings, depending on the mode and shipper profile. Building relationships with multiple carriers increases negotiating leverage, and conducting regular freight audits helps catch billing errors and recover overcharges.

Leveraging Technology for Better Tracking

Beyond transport planning, real-time tracking technologies take logistics optimization to the next level. Control tower software integrates data from various sources, enabling quick decision-making. These platforms provide a centralized view for tracking shipments and monitoring inventory, helping identify delays before they disrupt delivery schedules.

New technologies are revolutionizing shipment visibility. AI-powered supply chains are 67% more efficient than traditional systems, and 40% of companies now use cloud-based solutions to enhance supply chain management. IoT devices play a crucial role in tracking inventory and monitoring equipment during transit. For the cotton industry, QR codes and blockchain technology are becoming game-changers, allowing bales to be traced from farm to port. This addresses a longstanding challenge of limited information sharing across the cotton supply chain, which often spans vast geographic areas.

Advanced route planning software also makes real-time adjustments based on traffic, weather, and port schedules. These tools ensure that cotton shipments reach export facilities on time and in optimal condition, avoiding delays or quality issues.

Using the cottongins.org Directory

As logistics grow more time-sensitive, the cottongins.org directory simplifies the process of finding cotton gins, which are a vital link between farms and export operations. This directory serves as a centralized resource for industry professionals, making it easier to locate gins across key U.S. cotton-producing states like Texas, Georgia, California, and North Carolina. With the cotton industry projected to reach a value of $5.8 billion by 2025, having quick and accurate access to contacts can save precious time. The directory not only provides essential contact details but also integrates smoothly into broader supply chain operations.

Locating Cotton Gins by State and County

The directory categorizes gins by both state and county, catering to regional logistics needs. Listings are available for states such as Alabama, Arkansas, Arizona, California, Florida, Georgia, Kansas, Louisiana, Mississippi, Missouri, New Mexico, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, and Virginia. Each listing includes the gin’s name, full street address, city, and phone number, making it easy to input this information into GPS or route-planning tools. This allows users to calculate distances, estimate fuel costs, and schedule pickups efficiently.

For trucking companies and logistics managers, this geographic organization is a game-changer. Instead of hunting down contacts one by one, they can quickly locate nearby gins or even identify backup facilities in neighboring counties during busy seasons. Growers and cooperatives also gain a clear advantage: comparing drive times, verifying receiving hours, and reviewing bale-handling procedures becomes much simpler when all the necessary information is consolidated in one searchable database. Additionally, cottongins.org offers opportunities for businesses to increase their visibility within the industry.

Sponsorship Options for Industry Visibility

In addition to its directory services, cottongins.org provides sponsorship packages designed to help service providers connect with gin managers, growers, and logistics professionals. There are three sponsorship tiers available:

- Sponsored Posts: $200 for a one-day feature, including promotion on social media.

- Official Sponsorships: $200 per month, which includes your logo and a backlink in the footer, plus one free Sponsored Post annually.

- Featured Sponsorships: $400 per month, offering top placement, footer visibility, and two free Sponsored Posts annually.

These sponsorships are particularly valuable for trucking companies, warehouses, insurance providers, and technology vendors. By placing your brand in front of decision-makers at the exact moments they’re planning routes, comparing services, or exploring new partnerships, you gain a competitive edge. Managed by the Southern Cotton Ginners Association, the directory carries industry trust and reaches professionals who oversee ginning schedules, bale volumes, and shipping logistics across the cotton belt. Sponsorships not only improve visibility but also create direct connections with key players in the industry.

Conclusion

Getting cotton from U.S. farms to export destinations requires careful coordination across multiple steps: baling, short-haul trucking, warehousing, rail transport, and port handling. With U.S. production expected to reach 14.3 million 480-pound bales by 2025, along with rising ending stocks of 4.4–4.5 million bales and farm prices hovering around $0.60 per pound, efficient logistics become crucial. These logistics choices not only impact costs per bale but also preserve fiber quality for export markets.

The industry faces some tough challenges, including container shortages, congestion at major ports like Los Angeles/Long Beach, and a persistent truck driver shortage that has driven up freight costs. However, these hurdles also present opportunities. Federal investments in infrastructure, improved freight policies, and integrated warehousing solutions are gradually helping stabilize cotton supply chains. Diversifying port usage - by incorporating Gulf and East Coast facilities alongside the usual West Coast routes - and working with specialized logistics providers can reduce risks and keep delivery schedules on track. These efforts highlight the importance of forward-thinking, data-driven logistics planning.

Proactive planning, supported by accurate data, is the key to staying ahead. Tools like USDA production forecasts, National Cotton Council acreage surveys, and real-time tracking platforms enable better decision-making. These resources help anticipate bale volumes, reserve warehouse space early, and secure better freight rates before peak seasons. Evaluating warehousing and port options, while collaborating with shippers' associations or freight forwarders, can fine-tune logistics strategies even further.

Additionally, resources like the cottongins.org directory simplify decision-making. This tool allows users to locate gins by state and county, reducing first-mile transportation distances, identifying facilities near highways or railheads, and coordinating pickups during harvest. Whether you’re a grower arranging deliveries, a trader sourcing bales, or a logistics manager planning routes, having this information in one searchable place saves time and lowers costs. For service providers - such as trucking companies, warehouses, or insurers - sponsorship options on platforms like this ensure visibility at key decision-making moments.

Logistics should be seen as a competitive edge, not just a cost. With cotton acreage declining by 14.5% but yields improving to over 920 pounds per acre, every bale counts. Tightening logistics planning, maintaining cotton quality through proper storage and handling, and using reliable tools to anticipate disruptions will make all the difference. Those who master these fundamentals - whether growers, ginners, or shippers - will secure their margins and market share, even as the industry navigates tighter conditions.

FAQs

What are the biggest challenges in moving cotton from farms to export ports?

Moving cotton from farms to export ports isn’t without its obstacles. Port congestion and container shortages often lead to shipment delays. On top of that, rising transportation costs and a shortage of truck drivers add layers of complexity to the process. The supply chain is further strained by regulatory uncertainties and fluctuating tariffs, which can disrupt operations and drive up shipping expenses.

Tackling these issues requires proactive strategies. Preparing for delays, keeping up-to-date with regulatory shifts, and using efficient storage and tracking systems can help ensure cotton maintains its quality and reaches its destination on time.

What are the pros and cons of using rail versus trucking to transport cotton to export ports?

Rail transport shines when it comes to long-distance shipping, often cutting costs by as much as 50% per ton-mile. It’s also a greener option, producing up to 75% fewer greenhouse gas emissions compared to trucking. But it’s not without its challenges - rail tends to be less flexible, with longer transit times and fewer options for short or time-sensitive deliveries.

Trucking, meanwhile, excels in speed and flexibility. It provides faster, door-to-door service, making it the go-to choice for shorter distances or urgent shipments. The downside? Higher costs and a bigger environmental footprint.

Many logistics operations strike a balance by using multimodal strategies. This approach combines the strengths of both rail and trucking to optimize efficiency, control costs, and meet delivery deadlines.

What technologies help maintain cotton quality during storage and transportation?

Advanced technologies play a key role in preserving cotton quality during storage and transport. For instance, fiber quality monitoring systems analyze cotton in uniform modules, providing detailed classification data that ensures consistency. Programs like the USDA's module averaging initiative further support accurate evaluations, making sure quality remains reliable.

When it comes to transit, sealed containers and comprehensive chain-of-custody records are essential. These tools not only protect the cotton from contamination but also maintain full traceability. Adhering to regulatory standards, such as proper documentation for fiber content and origin, is equally important. These steps are critical for upholding quality and meeting export requirements.