The cotton ginning industry in 2025 is navigating a mix of rising costs, market uncertainties, and evolving technologies. Success hinges on balancing operational efficiency with market demands. Key takeaways include:

- Higher production volumes lower costs by spreading fixed expenses across more bales.

- Technology upgrades like automation and energy-efficient systems reduce labor and energy costs.

- Regional factors such as weather, transportation logistics, and production patterns significantly impact profitability.

- Revenue drivers include lint pricing, byproduct sales (e.g., cottonseed), and quality premiums.

- Cost challenges include rising energy prices, labor shortages, and regulatory compliance expenses.

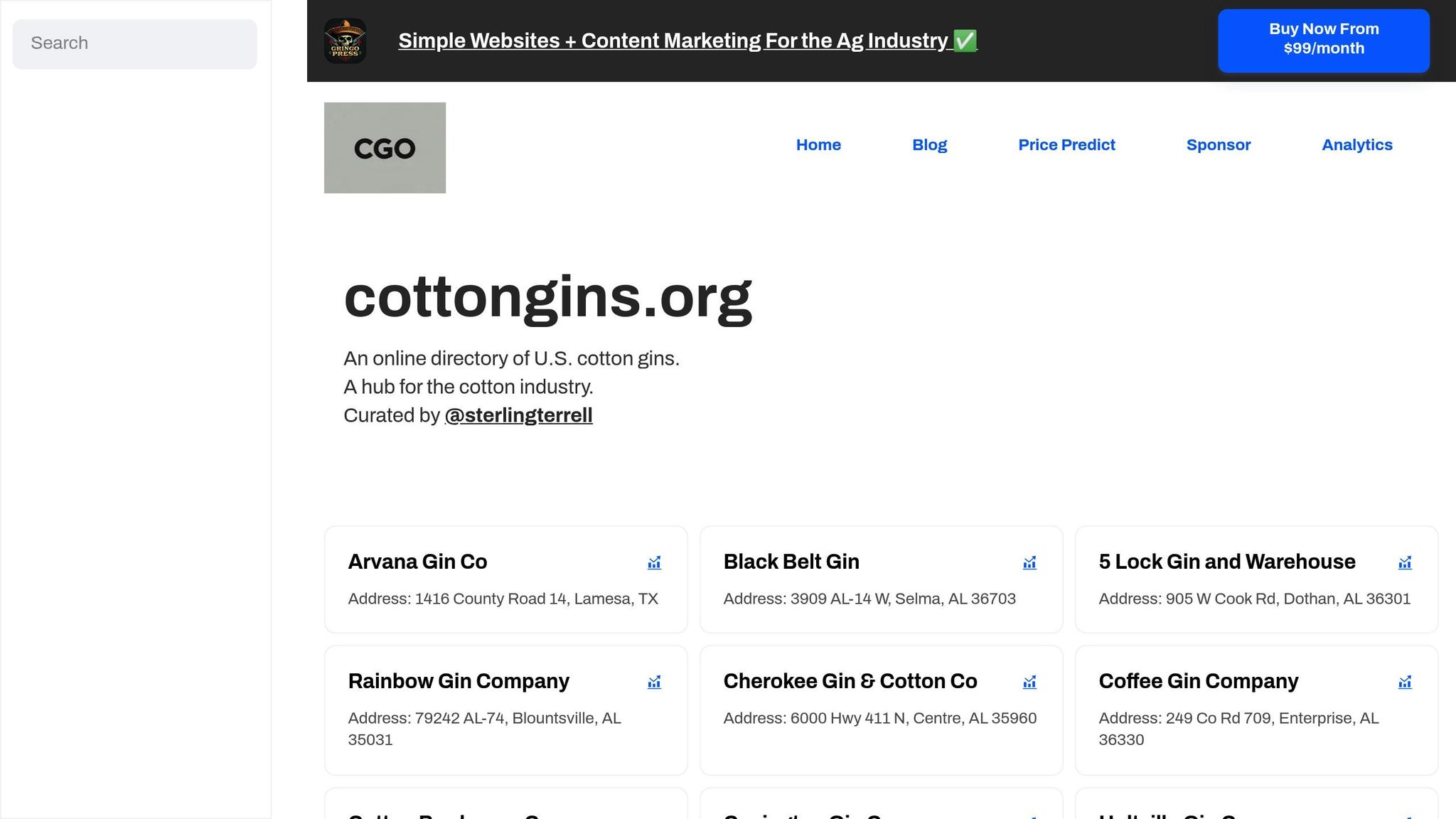

Operators can improve profitability by investing in modern equipment, managing costs effectively, and leveraging regional advantages. Tools like real-time analytics and directories for regional networking (e.g., cottongins.org) offer additional support for navigating 2025's challenges.

Big Country cotton gins face closure due to shrinking profits, labor shortages, weather

2025 Market and Volume Projections

Cotton gin operators are gearing up for a mixed outlook in 2025, as global market forces present both opportunities and hurdles. Keeping an eye on production trends will be key for managing operational capacity effectively. Changes in global markets have a direct impact on seasonal workloads and equipment use across the Cotton Belt.

Global Cotton Production and Trade Forecasts

Worldwide cotton production is projected to grow modestly in 2025, fueled by expanded farming in key regions. Stable import levels from major global buyers could provide a dependable demand base for U.S. cotton exports, which would, in turn, influence processing volumes at domestic gins.

However, trade tensions and fluctuating shipping costs are likely to disrupt global cotton flows. As textile manufacturers diversify their sourcing to strengthen supply chain resilience, U.S. gins may uncover new opportunities in international markets. At the same time, shifts in the U.S. dollar’s value could impact export demand and the overall workload for gins.

These global developments set the stage for examining how domestic production changes are reshaping local gin operations.

U.S. Cotton Production Patterns

After a tough few seasons, U.S. cotton production is bouncing back, with regional improvements expected to boost capacity utilization at local gins during peak times. The Southeast, in particular, is poised for stronger growth, offering facilities in the region a chance to move toward more efficient operations.

Still, weather unpredictability remains a challenge for major cotton-producing states, creating uncertainties for gin operators. Meanwhile, modest growth in domestic textile manufacturing could stabilize local demand, ensuring more consistent processing volumes.

Operating closer to full capacity during the busy season helps facilities manage costs more effectively. However, the intense concentration of ginning activity during peak periods demands precise scheduling to maximize efficiency.

Regional shifts in production also bring logistical considerations. Facilities in growing regions may enjoy lower transportation costs, while those in areas with declining output might face increased per-unit expenses. Additionally, the trend toward larger, consolidated farms is reshaping customer relationships, influencing pricing strategies and service expectations at gins.

Main Revenue Sources for Cotton Ginning in 2025

As markets evolve and technology advances, cotton ginning businesses are reshaping their strategies to stay ahead. Recognizing the key revenue streams is essential for optimizing operations and maintaining a competitive edge.

Lint Pricing and Byproduct Values

The price of lint remains the cornerstone of profitability for cotton ginners. While global supply challenges persist, higher-quality fibers are commanding premium prices. Additionally, the growing demand for cottonseed - used in animal feed and oil production - is creating new revenue opportunities. Byproducts like cotton linters and specialized fibers also contribute to income, especially when quality control measures are in place. Regional market dynamics can further influence these pricing trends. Investments in modern equipment and processes not only enhance fiber quality but also unlock additional income from byproducts.

Technology Impact on Quality and Premiums

Advances in technology are playing a pivotal role in increasing revenue. Upgraded roller and saw systems, along with tools for moisture control, color grading, and data analytics, are helping minimize fiber damage and ensure consistent quality. This consistency allows operators to secure premium prices. Additionally, innovations in packaging and handling are preserving fiber integrity, which is critical for maintaining these premiums.

Together, these advancements highlight how the industry is capitalizing on both market trends and technological progress to maximize revenue potential in 2025.

Cost Structure Changes in 2025

Cotton ginning operations in 2025 are grappling with rising costs, making careful expense management more important than ever. Keeping up with these shifts is essential for staying profitable in an evolving industry.

Energy Costs and Efficiency Improvements

Energy continues to be a major expense for cotton gins, with regional energy price variations creating uneven cost pressures. To tackle this, many operators are upgrading their equipment and adopting energy management systems. Tools like variable frequency drives, advanced moisture controls, and real-time energy monitoring software help optimize energy use. Scheduling tasks during off-peak hours is another strategy that's proving effective in cutting energy bills.

While energy costs remain a key focus, rising labor expenses are also reshaping how facilities operate.

Labor Costs and Automation

Labor shortages have led to higher wages, pushing facilities to invest in automation. Tasks like sampling, robotic bale handling, and warehouse management are increasingly automated to reduce dependency on manual labor. At the same time, facilities are prioritizing workforce training to ensure employees can effectively operate and maintain these advanced systems, boosting overall efficiency.

Environmental Compliance and Costs

Regulatory demands are another significant factor influencing cost structures. Stricter environmental rules require investments in areas like water usage monitoring, advanced dust filtration systems, and better waste management practices. While these updates come with hefty upfront and ongoing costs, they are essential for avoiding fines and ensuring operations remain compliant and sustainable in the long term.

Technology Improvements and Operational Efficiency

Technology is transforming the cotton ginning industry, making processes faster, reducing waste, and ensuring consistent product quality. These advancements not only improve efficiency but also help maintain competitive market prices.

Automation and Advanced Controls

Cotton gins are increasingly using automated sorting systems to remove foreign matter more effectively while preserving lint quality. Real-time fiber sensors allow for instant adjustments, ensuring uniform results throughout the process.

Integrated control systems also play a key role by managing moisture levels and timing, paving the way for modular and data-driven processing techniques.

Evolving Cotton Processing Methods

Building on automation, modular processing offers flexible solutions to handle different production volumes. Digital simulation tools are now used to test and fine-tune processing conditions before they’re applied, ensuring optimal performance.

Real-time analytics further enhance decision-making by identifying and resolving bottlenecks quickly. Improved tracking systems streamline the flow of cotton from processing to shipping, while mobile apps provide remote monitoring and fast issue resolution.

These advancements are setting the stage for cotton gin operations to become more efficient and adaptable as the industry looks toward 2025.

sbb-itb-0e617ca

Regional Profitability Factors for U.S. Gins

Cotton gins across the United States face distinct challenges tied to their geographic location. Factors like production patterns, transportation logistics, and labor costs vary widely, shaping the strategies operators need to consider as they plan for 2025.

Regional Production Changes

Each region brings unique dynamics to the table:

- Texas High Plains: Large-scale gins here benefit from economies of scale, even as they contend with weather unpredictability and water scarcity.

- Mississippi Delta: Gins in this area take advantage of high-quality cotton grown under favorable conditions. They’ve adapted their processes to handle various cotton types, which helps them maintain competitive pricing.

- Southeast: Diversification is key for gins in this region. Many supplement their seasonal income by offering seed processing and storage services.

- California’s San Joaquin Valley: Predictable, irrigation-supported production allows for efficient capacity planning and streamlined labor management, making high-volume operations feasible.

These regional differences in production tie directly to broader market trends and cost structures.

Transportation and Procurement Factors

Logistics play a critical role in regional profitability. Efficient transportation networks and access to storage facilities can significantly reduce costs and ensure a steady cotton supply. For example:

- Mississippi Delta: The Mississippi River system provides a cost-effective export route via barge.

- Texas and California: Proximity to rail networks and storage hubs keeps transportation costs manageable.

However, regional fuel price fluctuations and seasonal labor shortages add complexity. Rising wages during peak demand periods can drive up operational costs, further impacting profitability.

For detailed regional insights and competitive analysis, operators can turn to resources like cottongins.org. These regional nuances are essential for understanding the key metrics that will shape profitability in 2025.

Key Profitability Metrics and 2025 Benchmarks

For cotton gin operators aiming to remain competitive in 2025, understanding the right metrics is essential. U.S. cotton production is forecasted to reach 115.1 million bales, with domestic mills expected to consume 1.85 million bales during the 2024-25 fiscal year. These projections provide a foundation for evaluating the performance metrics that will define success in the coming year.

Core Metrics for U.S. Cotton Gins

Profitability in cotton ginning hinges on a few critical indicators, primarily focused on efficiency and cost control. One of the most important metrics is EBITDA per bale, which excludes variations from financing and depreciation. This allows operators to assess their core performance without being influenced by their capital structure.

Another key measure is the operating margin, which shows how much revenue remains after covering direct operating expenses. This is especially valuable in the cotton industry, where price fluctuations can quickly impact profitability. A strong operating margin reflects the ability to maintain stability even during volatile market conditions.

Cost per bale is another foundational metric, encompassing labor, energy, maintenance, and overhead expenses divided by the total number of bales processed. Tracking this figure helps operators identify the impact of technological advancements, such as automation, on reducing costs and improving efficiency.

Capacity utilization plays a significant role in profitability by leveraging economies of scale. Higher utilization spreads fixed costs across more bales, lowering per-unit expenses. With the anticipated rise in cotton production for 2024-25, many regions have an opportunity to boost their utilization rates.

Lastly, the lint turnout percentage is critical for revenue. This measures how much sellable cotton fiber is produced from each bale of seed cotton. Even small improvements in this percentage can translate into significant revenue gains when applied across thousands of bales. Together, these metrics offer a clear framework for comparing cost structures and operational performance between 2024 and 2025.

2024 vs. 2025 Cost Comparison Analysis

The shift from 2024 to 2025 introduces notable changes in cost structures, requiring operators to monitor key expenses closely.

Energy costs remain a major expense, prompting many gins to focus on reducing per-unit power consumption as input costs climb. Efforts to optimize energy usage are becoming increasingly critical.

Labor costs are also undergoing significant changes, driven by the rapid adoption of automation. Gins that have embraced advanced automation report lower labor costs per bale compared to those sticking with traditional methods.

Meanwhile, plant capital costs continue to challenge operators as they weigh the need for efficiency improvements against budget constraints. Choosing the right technology investments that deliver the highest return on investment is crucial in this evolving landscape.

These shifting dynamics underscore the importance of monitoring and adapting to cost drivers to remain competitive in 2025.

2025 Profitability Scenario Analysis Framework

The year 2025 brings a mix of challenges and opportunities, shaped by shifting market dynamics and production uncertainties. For operators, scenario planning becomes a critical tool to navigate these changes and make informed profit forecasts. This framework builds on earlier analyses of market trends and costs to provide a roadmap for strategic decision-making.

Baseline and Alternative Scenarios

Baseline Scenario

In the baseline scenario, market conditions remain stable. Cotton production aligns with forecasts, and lint prices stay within a predictable range. Under these conditions, operations typically yield consistent per-bale profitability, thanks to efficient processes and regional advantages. Energy costs are expected to rise slightly compared to prior years, but advancements in automation continue to reduce labor expenses. Transportation costs remain steady, and the pricing for cottonseed byproducts holds firm.

Tight Supply Scenario

A tight supply scenario emerges when cotton production falls short, caused by adverse weather or reduced acreage. This leads to higher fixed costs per bale as production volumes drop. While lint prices may rise due to scarcity, overall capacity utilization suffers, and procurement and energy expenses increase, further squeezing margins.

Strong Recovery Scenario

In a recovery scenario, favorable conditions push production beyond expectations. Higher production levels improve capacity utilization, even if increased supply exerts downward pressure on lint prices. Operational efficiencies from economies of scale can offset these pricing challenges, boosting profitability. However, to handle greater volumes, operators may need to invest in upgraded storage and handling systems.

These scenarios highlight the importance of understanding how different variables influence profitability, as explored in the next section.

Key Variable Sensitivity Analysis

Breaking down the impact of individual variables is crucial for managing profitability effectively. For instance, energy costs have a direct effect on per-bale earnings - higher rates can quickly erode margins. This makes energy efficiency and management investments a priority.

Labor costs and lint price fluctuations are other significant factors. Rising wages can strain budgets, but automation offers a way to control labor expenses. Similarly, proactive marketing strategies can help offset the risks of declining lint prices.

Capacity utilization also plays a pivotal role. Even small improvements in utilization can lead to better absorption of fixed costs, enhancing profitability. On the flip side, lower utilization - especially in tight supply scenarios - can pose serious challenges.

Regional differences further refine these analyses. Gins in high-production regions tend to be more resilient to volume shifts, while those in areas with limited production are more vulnerable to supply and demand changes. Tailoring strategies to these regional nuances is key to maintaining profitability in 2025.

Directory Resource for U.S. Cotton Gins

As the cotton industry navigates the challenges of 2025, having access to precise, location-based resources is essential for improving regional partnerships and streamlining operations. The following resource offers detailed insights to support these efforts.

cottongins.org Features

cottongins.org is a dedicated platform for U.S. cotton gins, offering a state-by-state directory to help stakeholders locate facilities across the country. Whether you're a cotton producer or an operator, the platform provides detailed information, such as facility names and addresses, for key cotton-producing states. For example, users can find listings like Arvana Gin Co in Lamesa, TX, ensuring accurate and convenient planning for transportation and collaboration.

The platform also includes a "Submit A Gin" feature, allowing operators to add their facilities directly. This self-service option ensures the directory remains up-to-date while expanding its reach to include more facilities across the country.

Additionally, cottongins.org offers structured sponsorship packages designed to enhance regional visibility. These tiered options range from priority placement to exclusive feature highlights, providing operators with an opportunity to stand out while fostering connections and improving cost management.

Benefits for Regional Stakeholders

For cotton gin operators and other stakeholders, the directory offers several key advantages that help address market uncertainties and improve profitability:

- Improved Procurement Efficiency: The directory's state-by-state organization enables cotton producers to easily find nearby gins, reducing transportation costs and simplifying logistics.

- Enhanced Regional Networking: Beyond locating facilities, the platform helps stakeholders identify potential partnerships, backup processing options, and regional capacity distribution. This is especially valuable for contingency planning in competitive or high-density regions.

In addition to these operational benefits, the sponsorship options allow gin operators to differentiate themselves by showcasing specific services or capabilities. During tight-margin periods, this visibility can help maintain or grow market share without significant marketing expenses.

For broader agricultural stakeholders, the directory offers insights into regional processing infrastructure. This data supports strategic planning in areas like cotton marketing, transportation logistics, and regional development. By identifying gaps or areas of concentration in processing capacity, stakeholders can better understand how regional dynamics impact competitiveness.

A Centralized Solution for the Cotton Industry

The platform’s founder, Sterling Terrell, created cottongins.org to address the fragmented nature of cotton gin location information. By centralizing these details, the directory benefits the entire cotton value chain. A mailing list feature further enhances engagement by keeping users informed about updates and industry news, fostering a sense of community within the cotton ginning sector.

Conclusion: 2025 Insights and Strategies

As the cotton ginning industry looks toward 2025, it faces a mix of challenges and opportunities shaped by shifting market demands, advancements in technology, and increasing cost pressures. Strategic planning will be crucial for staying competitive.

Investing in modern control systems and advanced technologies can help lower energy use and reduce operating expenses. While automation may come with a steep upfront cost, it offers long-term savings by cutting labor expenses and ensuring consistent processing standards.

Location also plays a key role. Gins situated close to major cotton-growing regions can save significantly on transportation costs, making regional partnerships more important than ever. Building strong connections within these areas can enhance efficiency and profitability.

Maintaining high-quality cotton remains non-negotiable for securing premium prices. Upgrading cleaning equipment and focusing on employee training can improve fiber quality, directly impacting revenue. Additionally, platforms like cottongins.org provide valuable opportunities to expand networks and strengthen operational collaboration.

By prioritizing energy efficiency, fostering regional partnerships, and improving product quality, operators can create a solid foundation for profitability. Combining these operational improvements with smart market strategies will be key to navigating the challenges of 2025.

Ultimately, blending traditional practices with modern efficiency measures positions operators for long-term success. With the right approach, the industry can adapt and thrive in the face of evolving demands.

FAQs

What strategies can cotton gin operators use to reduce rising energy and labor costs in 2025?

To tackle the increasing energy and labor costs expected in 2025, cotton gin operators should look toward automation and energy efficiency as key solutions. Automated systems, such as robotic technologies, can help cut down on labor expenses while increasing overall productivity. These systems not only simplify operations but also address challenges like labor shortages.

On the energy front, operators can take practical steps to reduce consumption. Simple measures like insulating hot air ducts, sealing leaks, and keeping equipment well-maintained can make a big difference. Since energy expenses make up a significant portion of operational costs, improving efficiency in these areas can result in noticeable savings. By combining automation with energy-saving practices, operators can better control costs and maintain profitability in the ever-changing cotton ginning industry.

What technologies should cotton gins adopt to improve profitability in 2025?

To improve profitability in 2025, cotton gins should focus on integrating automation and robotics. These technologies can help streamline operations, cut labor expenses, and boost efficiency. Upgrading to energy-efficient ginning machines with better dust collection systems and improved seed handling features can further enhance productivity while reducing operational costs. Additionally, utilizing AI-powered systems for tasks like process optimization, predictive maintenance, and quality control can minimize downtime and ensure smoother performance. Embracing these advancements will allow cotton gins to remain competitive and thrive in a rapidly changing market.

What regional factors affect the profitability of cotton ginning operations across the U.S.?

Regional differences significantly influence the profitability of cotton ginning operations across the U.S. Factors like labor costs, climate, and soil conditions play a direct role in determining how efficiently gins operate and the quality of cotton produced. For instance, regions with lower labor costs and favorable growing conditions often see better profit margins thanks to reduced overhead and higher-quality yields.

Another critical element is the proximity to transportation infrastructure. Gins situated near major highways or rail lines can cut down on shipping expenses and reach markets more quickly, giving them a competitive edge. Beyond these, aspects such as local regulations and energy costs also shape how profitable a cotton gin can be in different regions.