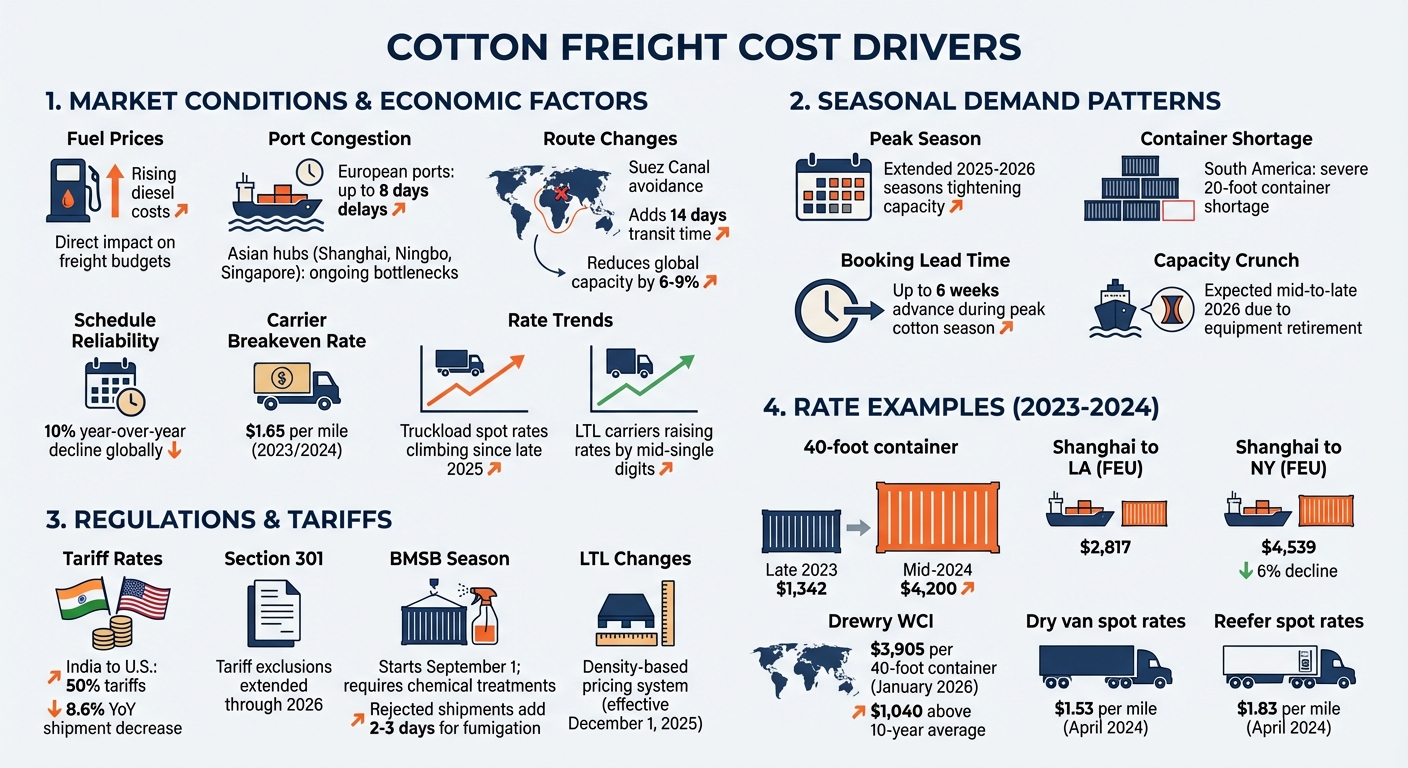

Freight costs can make or break your cotton business. With rates fluctuating due to fuel prices, seasonal demand, and global events, knowing how to negotiate effectively is critical. For instance, spot rates for a 40-foot container jumped from $1,342 in late 2023 to $4,200 by mid-2024. Without preparation, these shifts can eat into your profits.

Here’s what you need to know:

- Key cost drivers: Fuel prices, port congestion, seasonal shipping patterns, and regulations like tariffs or biosecurity rules.

- Market trends: Tightening capacity is expected in 2026 due to equipment shortages and extended peak seasons.

- Preparation tips: Gather accurate shipment data, track market indices like Drewry WCI, and plan bids during low-demand periods.

- Negotiation tactics: Lock in long-term contracts, address hidden fees upfront, and build strong carrier relationships.

- Tools to use: Freight rate calculators (e.g., SeaRates, Freightquote), market reports (e.g., Xeneta, DAT), and directories for reliable partners.

Bottom line: To secure better rates, focus on data-driven planning, timing, and collaboration with carriers. Start early, negotiate strategically, and monitor trends to stay ahead.

How to Negotiate Freight Rates with Forwarder | Freight Forwarder Rate Strategies That Actually Work

What Affects Cotton Freight Costs

Cotton Freight Rate Drivers and Cost Factors 2024-2026

Understanding what drives your freight costs is essential for effective negotiation. These costs are influenced by a mix of market trends, seasonal shipping patterns, and regulatory requirements - factors that can significantly impact your bottom line. Let’s break down these elements to see how they shape freight pricing.

Market Conditions and Economic Factors

Fuel prices have a direct impact on freight budgets, with rising diesel costs pushing expenses higher. On top of that, port congestion remains a major issue. For example, some European ports are experiencing delays of up to eight days, while major Asian hubs like Shanghai, Ningbo, and Singapore continue to face bottlenecks.

Geopolitical events further complicate matters. For instance, some carriers are avoiding the Suez Canal in favor of routes around the Cape of Good Hope, adding about 14 days to transit times and reducing global shipping capacity by 6–9%. This has contributed to a 10% year-over-year decline in global schedule reliability, making it harder to predict when your cotton shipments will arrive.

Carrier capacity is another key factor. Truckload spot rates have been climbing since late 2025, with forecasts suggesting further increases through 2026. LTL carriers, despite lower volumes, are raising rates by mid-single digits. For context, the breakeven rate for carriers in 2023/2024 operations is approximately $1.65 per mile, which sets a practical limit on how low rates can drop.

Seasonal Demand and Cotton Shipping Patterns

Cotton shipping tends to follow harvest cycles, but recent years have seen extended peak seasons. For example, the 2025 and 2026 seasons are lasting longer than usual, tightening capacity for longer stretches. Winter weather disruptions also play a role - early December 2025 saw spot rates spike due to severe weather events.

Exporters in North America, particularly those shipping westbound or to Europe, are grappling with tight ocean freight capacity. South American exporters face their own challenges, such as a severe shortage of 20-foot containers. During peak cotton season, bookings often need to be made up to six weeks in advance. Missing gate-in deadlines at ports can lead to General Rate Increase (GRI) adjustments, further inflating costs.

The freight market is currently in what analysts call a "payback phase" following a mid-2025 surge. A tightening cycle is expected to hit by mid-to-late 2026 as older equipment is retired without sufficient replacements, creating a capacity crunch. These seasonal trends highlight the importance of planning ahead to secure better rates.

Regulations and Tariffs

Trade policies can have a direct impact on your landed costs. For instance, a U.S.-China agreement in November 2025 reduced some tariffs and paused certain port-related taxes, giving shippers more predictability. Section 301 tariff exclusions have also been extended through 2026, offering temporary relief on specific trade routes. However, tariffs on Indian exports to the U.S. remain steep at 50%, contributing to an 8.6% year-over-year decrease in shipments from that region.

Biosecurity regulations add another layer of complexity. The Brown Marmorated Stink Bug (BMSB) season, starting September 1, requires specific chemical treatments for cargo. Missing documentation for these treatments can result in rejected shipments or fumigation at the destination, which adds 2–3 days to the process. In late 2025, regions like New York faced severe bottlenecks due to a lack of approved fumigation providers.

Changes in freight classification are also reshaping costs. As of December 1, 2025, major carriers like FedEx have adopted a density-based pricing system for LTL shipments. Errors in reporting weight, density, or dimensions on the Bill of Lading now trigger inspection surcharges. Additionally, new U.S. regulations on demurrage and detention fees have created friction between shippers and carriers, further affecting shipping expenses.

How to Prepare for Negotiations

Getting ready for negotiations is a must if you want to secure better rates, especially when the market is unpredictable. Walking into a negotiation without solid data can hurt your bottom line.

Gather the Right Data

Start by collecting accurate shipment records. This includes exact pallet dimensions and density, which can help you avoid unnecessary inspection fees caused by misclassification. Double-check that all measurements comply with the latest carrier standards.

Next, pull together historical cost data. Include all surcharges, which can make up as much as 30% of your total costs. If your business focuses on exports, keep an eye on USDA data for container ocean freight rates on westbound transpacific routes and grain barge rates for inland shipping.

Use this internal data as a foundation when you compare it to broader market trends. This ensures your benchmarks are both accurate and actionable.

Track Freight Market Trends

Stay ahead by following market indices that track freight trends. Tools like the Drewry World Container Index (WCI) and Xeneta Shipping Index (XSI-C) can give you real-time insights into short- and long-term market averages. For example, in late 2025, the WCI dropped 2.6% in a single week, marking five straight weeks of decline. During that period, trans-Pacific spot rates from Shanghai to Los Angeles were $2,817 per forty-foot equivalent unit (FEU), while rates to New York fell 6% to $4,539 per FEU.

"What is meant by 'stop negotiating with yourself' is stop driving reduction targets by what was spent last year."

- Rick LaGore, CEO, InTek Freight & Logistics

Timing plays a big role too. For seasonal goods like cotton, Katherine Barrios from Xeneta advises: "If you are a BCO, that deals with seasonal cargo such as tobacco, cotton, fruits, wool, etc. you will need to negotiate your rates well in advance of the next season". Starting your bids during periods of lower demand - outside peak shipping seasons - can lead to better deals, as carriers often lower prices to secure business.

Define Your Goals

Once you've analyzed your data and the current market, it’s time to define your negotiation goals. Set clear targets, such as a preferred rate, a walk-away rate, and a 12-month volume forecast, all based on current market conditions. Identify service priorities, like transit times and specific equipment needs.

Plan for a 10%–15% buffer in your budget to handle unexpected disruptions. To stay agile, create a routing guide that ranks carriers by rates and service levels. This way, your team can quickly pivot if a primary carrier becomes unavailable. Lastly, negotiate accessorial charges upfront - things like detention fees, layovers, and fuel surcharges. These hidden costs can eat into your profits if left unaddressed.

sbb-itb-0e617ca

Negotiation Tactics for Cotton Freight

Use Long-Term Contracts

Locking in multi-year contracts can shield your operations from the ups and downs of the market. These agreements provide stability by securing rates and guaranteeing capacity during high-demand periods.

When drafting these contracts, include renegotiation clauses and tie fuel surcharges to benchmarks like the Department of Energy (DOE) index. This protects both you and the carrier against sudden diesel price spikes. Committing to consistent long-term volumes also gives you bargaining power to secure better rates and priority service.

To hold carriers accountable, incorporate Service Level Agreements (SLAs) that outline expectations for transit times, equipment availability, and cargo handling. Add penalties for non-compliance to ensure standards are met. Align your shipping forecasts with these agreements to keep terms relevant as your business evolves.

These long-term contracts also open doors to renegotiate accessorial fees, helping you manage costs more effectively.

Negotiate Extra Services

Freight costs go beyond base rates. Charges like detention, liftgate services, and limited access fees can add up, often accounting for 5% to 10% of total freight expenses. To avoid surprises, negotiate flat rates or caps for these recurring charges upfront.

Ask carriers for a detailed breakdown of fees to eliminate unexpected invoice charges. For example, using lighter equipment can increase payload capacity by 5,000 lbs, improving your cost-per-pound ratio. Additionally, offering flexibility, like a two-day delivery window instead of next-day, can sometimes earn you a 10% discount.

"A carrier with slightly higher rates but fewer service failures often saves more money overall." - Knapsack Creative, TFWW

For long-distance shipping, consider intermodal options like combining rail and truck. This approach can significantly cut costs while maintaining similar delivery times. Be sure to clarify liability limits beforehand, as standard carrier coverage often ranges between $0.50 and $2.00 per pound.

Negotiating these extra services strategically can make a noticeable difference in your overall freight spend.

Build Carrier Relationships

Strong relationships with carriers can be a game-changer. Carriers tend to prioritize shippers who provide accurate forecasts, pay on time, and stick to scheduled pickups. These partnerships can lead to "first-call service", ensuring capacity during tight markets or seasonal peaks.

"The more you treat the carrier as a partner, the more opportunities there are for win-win opportunities that bring the carrier's costs down, which will then be passed to your bottom line." - Rick LaGore, CEO, InTek Freight & Logistics

To ensure reliability on critical cotton shipping routes, consider awarding lanes to multiple carriers. Over time, carriers that understand your freight needs and dock operations can offer more precise pricing and reduce service failures. Building trust and collaboration with your carriers not only improves service but also strengthens your position during negotiations.

Tools and Resources for Freight Negotiations

Freight Rate Calculators

Freight rate calculators are indispensable for avoiding overpayment on cotton shipments. SeaRates Logistics Explorer, for instance, compares over 500,000 ocean freight quotes in real time, helping you identify competitive rates across various carriers. For domestic shipping, Freightquote by C.H. Robinson provides instant quotes for both LTL and truckload options - no signup required.

If you're transporting cotton modules to the gin, the Cotton Module Transport Calculator from Texas A&M and Cotton Incorporated is tailored specifically for this purpose. This Excel-based tool simplifies cost analysis by balancing hauling expenses against gin capacity. It uses four key inputs: rated gin capacity, average bales per module, estimated bales within specific distance ranges, and module truck fuel costs.

For benchmarking freight rates, platforms like Xeneta, DAT Freight & Analytics, and Truckstop.com offer real-time market data alongside historical rate analysis. These tools help you compare current rates with past spending, enabling quick adjustments to market shifts.

Market Reports

Market reports go beyond calculators, providing deeper insights to strengthen your negotiation strategy. For example, the Drewry World Container Index (WCI) tracks weekly container pricing. As of early January 2026, the composite index stood at $3,905 per 40-foot container - $1,040 higher than the 10-year average.

Xeneta is another powerful resource, offering real-time benchmarking based on over 500 million data points from top shipping companies. In August 2025, Grasim Industries Limited, part of the Aditya Birla Group, adopted Xeneta’s platform to streamline freight negotiations on complex trade lanes like Laem Chabang to Long Beach. Jeevan Pawar, Head of Global Supply Chain, praised the platform:

"We needed to know where we stood against the market and how to use these insights to drive better negotiations with shipping lines and freight forwarders - Xeneta gave us that clarity".

Understanding freight market cycles is equally critical. Markets typically move through four phases: Early (rising), Mid (plateau), Late (declining), and Bottom (gradual decline). Recognizing the "Late" or "Bottom" phases from market reports can give you an edge in negotiations, as carriers are more likely to offer favorable terms during these periods. For instance, as of April 2024, dry van spot rates were $1.53 per mile, while reefer spot rates were $1.83 per mile.

Directories for Finding Partners

Once you've gathered rate data, the next step is securing reliable partners to execute your agreements. Cottongins.org is a specialized directory that connects you with U.S. cotton gins and logistics providers who are well-versed in the unique demands of cotton transportation. Working with these experts often leads to better rates, as they can offer more accurate pricing tailored to cotton handling needs.

For broader logistics solutions, GoComet provides a multi-modal platform featuring a "Recursive Rate Reduction" system that automates benchmarking to secure competitive contract and spot rates. Similarly, InTek Freight & Logistics specializes in addressing complex challenges, such as leveraging 53-foot intermodal capacity and managing intricate routing.

When selecting providers, consider using a weighted scoring system to evaluate key factors like capacity, reliability, insurance coverage, and financial stability before inviting them to submit their rates. Implementing a Transportation Management System (TMS) can also be a cost-effective move. On average, a TMS costs about $4 per shipment compared to $15–$25 when outsourcing to a logistics service provider. A high-quality TMS typically delivers a return on investment in under 12 months, with implementation taking just 30 to 60 days.

Conclusion

To negotiate cotton freight rates effectively, you need a strategy that safeguards your profit margins while adapting to market shifts. Freight rates can change rapidly, as we've seen before, and without proper preparation, these fluctuations can deeply affect your bottom line.

Start by arming yourself with accurate shipping data and a clear cost breakdown. Platforms like DAT and Truckstop.com can help you track market trends. Break your costs into key components: base rates, fuel surcharges, and accessorial fees, which typically make up 5% to 10% of your total freight spend. Rick LaGore, CEO of InTek Freight & Logistics, emphasizes the importance of data access:

"In the time of big data and transparency, shippers need to know they have the ability to tap into the same market data that carriers and logistics companies have at their fingertips".

Strong negotiation tactics are just as critical as having solid data. Focus on building long-term partnerships with carriers, negotiating flat rates for recurring accessorial charges upfront, and timing your RFPs during periods of lower capacity. As Knapsack Creative wisely notes:

"Negotiation isn't about winning - it's about alignment".

Diversifying your carrier relationships can also boost your flexibility, especially during capacity crunches. This approach is key to addressing the unique challenges of shipping cotton.

Once your strategy is in place, stay proactive. Conduct quarterly reviews of carrier performance and keep an eye on rejection rates, as they can signal tightening capacity. Instead of relying on last year's data, leverage real-time market indexes to uncover accurate rate opportunities. Remember, carriers are using advanced data to optimize their networks - real-time insights can ensure you remain competitive.

FAQs

How can I use freight rate calculators to negotiate better cotton shipping rates?

Freight rate calculators are a handy resource when it comes to negotiating better shipping rates for cotton. Start by gathering precise shipment details, like the number of cotton modules, their weight (in pounds), dimensions (in inches), and the ZIP codes for both the origin and destination. Plug this information into a dependable freight rate calculator to generate an estimated cost in U.S. dollars. This estimate can serve as your baseline for comparison.

After that, reach out to several carriers and request quotes using the same shipment details. Compare their quotes against the calculator’s estimate to spot any major differences. Freight rate calculators often provide a breakdown of costs - such as fuel charges and mileage - which can help you identify where a carrier’s pricing might be inflated. Use this data strategically during negotiations to advocate for a lower rate or better terms, like volume discounts or enhanced service options. Once you settle on terms, make sure to get the agreed-upon rate in writing for future reference.

What are the best strategies for managing cotton freight costs during seasonal demand changes?

To keep cotton freight costs in check during times of fluctuating seasonal demand, here are some practical approaches:

- Secure rates in advance: Use forward contracts or blended agreements combining contract and spot rates to shield yourself from unexpected price jumps.

- Combine shipments: Grouping shipments can help you qualify for volume discounts, cutting down on per-unit transportation costs.

- Leverage planning tools: Freight rate calculators and market trend reports can help you anticipate peak seasons and negotiate more favorable terms.

- Stay updated on market factors: Keeping an eye on fuel prices and seasonal demand forecasts allows you to adjust carrier capacity and refine shipping routes for better efficiency.

By incorporating these methods, you can manage freight expenses more effectively and safeguard profits, even when market conditions shift.

How do geopolitical events affect cotton freight rates, and how can shippers adapt?

Geopolitical shifts - like changes in trade policies, tariffs, or regional conflicts - can have a noticeable effect on cotton freight rates. These factors often disrupt carrier capacity, influence fuel prices, and lead to port congestion. For example, the introduction of new tariffs can drive up costs as carriers pass along the added expenses, while easing political tensions might increase capacity and bring rates back down.

To adapt to these fluctuations, staying informed about market trends and policy updates is key. Shippers can consider diversifying their shipping routes, blending contract and spot shipments, or even exploring alternative ports to keep operations flexible. Adding tariff-adjustment clauses into contracts is another way to manage unexpected costs. Armed with market knowledge, adaptable strategies, and data-driven tools, you’ll be better positioned to negotiate rates and safeguard your business against the unpredictability of geopolitical events.