Cotton subsidies in the U.S. shape both domestic and global markets. They provide financial support to farmers, ensuring stable incomes and reducing risks tied to unpredictable weather or market conditions. However, these programs also disrupt natural supply and demand, leading to overproduction and lower cotton prices worldwide. Key points include:

- Domestic Impact: Subsidies boost farmer income through crop insurance, loans, and disaster aid, enabling long-term planning and access to capital. They also influence planting decisions, often leading to surplus production.

- Global Consequences: Overproduction lowers global cotton prices, creating challenges for farmers in developing countries and sparking trade disputes, such as Brazil's successful case against U.S. subsidies at the WTO.

- Policy Evolution: U.S. farm bills have shifted toward market-driven support to address trade concerns, focusing on income-based aid and risk management rather than direct production incentives.

Balancing support for U.S. farmers with global trade fairness remains a complex challenge for policymakers.

Agricultural Subsidies: Corporate Welfare for Farmers

How Subsidies Change Cotton Prices

Federal subsidies significantly influence cotton markets by disrupting the natural balance of supply and demand. These subsidies not only provide financial support to farmers but also lead to shifts in cotton pricing, both domestically and globally. The resulting changes in supply and demand dynamics are explored below.

Effects on Supply, Demand, and Pricing

Cotton subsidies often lead to increased production levels that exceed what the market would naturally support. Programs like guaranteed payments and crop insurance encourage farmers to plant cotton even when market conditions signal otherwise. This overproduction creates a surplus, which drives prices down.

Without these subsidies, many farmers might pivot to growing other crops. However, programs like marketing assistance loans create a safety net by covering losses, effectively setting a price floor. This intervention prevents cotton prices from fully reflecting actual market conditions. As a result, production remains high, even in less-than-ideal circumstances.

The surplus generated by these measures doesn’t just affect domestic markets - it spills into global markets, further driving down prices worldwide.

Price-Based vs. Non-Price-Based Subsidies

Subsidies influence the market in different ways, depending on their structure. Price-based subsidies, such as lending programs and direct payments, establish minimum price levels during market downturns. On the other hand, non-price-based subsidies, including crop insurance, disaster aid, and conservation programs, lower the risks and costs of production.

While non-price-based subsidies don’t manipulate prices as directly, they still impact market dynamics by making cotton production less risky and more affordable. This, too, contributes to overproduction and the resulting price declines.

Together, these subsidy programs sustain higher levels of cotton production and keep prices lower than they would be in a free-market system. The result is a market where cotton prices are shaped not only by supply and demand but also by the influence of government intervention.

Effects on U.S. Cotton Producers

Subsidies play a dual role in the cotton industry: they influence market prices while providing a financial safety net for producers. These government programs directly impact production decisions and help U.S. cotton farmers manage financial risks.

Higher Revenues and Reduced Risks

Subsidies bring stability to cotton farming by protecting producers from the unpredictability of agricultural markets. Programs like marketing assistance loans ensure farmers receive a minimum price for their cotton, even during market downturns. This guaranteed income allows producers to plan operations with greater confidence.

Crop insurance is another crucial tool, covering losses from events like droughts, pest outbreaks, or other natural challenges. For instance, if a severe drought destroys a cotton crop, insurance payouts can recover much of the lost revenue. This safety net encourages farmers to keep producing cotton, even in regions where environmental risks might otherwise discourage them.

This financial stability also impacts borrowing. Banks and lenders see subsidized cotton farms as lower-risk investments, making it easier for farmers to secure loans for operations or new equipment. Access to capital often leads to investments that improve productivity.

Additionally, direct and counter-cyclical payments help maintain a baseline income during tough economic times. These payments ease financial pressure, preventing farm closures during downturns.

Shaping Planting Decisions and Regional Impacts

Subsidies don’t just stabilize incomes - they also influence what and where farmers plant. With guaranteed payments and reduced risks, cotton becomes a more appealing crop, even when market conditions might suggest planting something else. This can lead to cotton being grown in areas where it might not be the most economically sound choice based solely on market signals. These shifts often contribute to production surpluses, as previously noted.

The effects of subsidies vary by region. In Texas, for example, programs that support both dryland and irrigated systems benefit cotton farmers significantly. In the Southeast, where cotton competes with peanuts and soybeans, subsidies can tip the scales, encouraging farmers in states like Georgia and North Carolina to prioritize cotton over other crops. This often leads to changes in crop rotation patterns, with more acreage dedicated to cotton when subsidies are particularly generous.

California cotton farmers also depend heavily on federal programs to stay competitive. While guaranteed payments may reduce the urgency to maximize efficiency, some subsidy programs promote environmentally friendly practices, such as precision agriculture and water conservation.

Smaller family farms experience these benefits differently than larger commercial operations. Targeted subsidies often provide greater support to smaller producers, helping to sustain family-owned cotton farms and preserve their role in the industry.

Global Effects of U.S. Cotton Subsidies

U.S. cotton subsidies aim to bolster domestic producers, but they also disrupt global cotton markets, triggering consequences that extend far beyond American borders.

Lower Prices and Challenges for Developing Countries

By increasing U.S. cotton production, subsidies push global prices downward. For cotton-producing nations, especially those in developing regions where the crop is a cornerstone of the economy, this creates a tough competitive landscape. When prices drop, small-scale farmers in these countries often face shrinking incomes, which can ripple through their local economies, exacerbating financial instability and economic challenges.

Trade Disputes and International Tensions

The global ramifications of these subsidies have sparked trade disputes, with other nations arguing that such policies distort markets and create unfair competition. These disagreements highlight how domestic policies can complicate international trade dynamics, raising questions about equitable practices in the global market.

The interplay between domestic subsidies and their unintended international effects continues to fuel debate, as policymakers grapple with balancing national interests and global trade fairness.

sbb-itb-0e617ca

Policy Changes and Future Outlook

The U.S. cotton subsidy system is undergoing changes as lawmakers aim to support domestic farmers while addressing global trade challenges.

Changes in Recent Farm Bills

Recent Farm Bills have introduced updates to subsidy programs, moving away from traditional models toward more market-focused strategies. Cotton producers now have access to programs that provide aid during tough market conditions, and the list of eligible commodities has expanded. These updates are designed to better align U.S. policies with international trade rules and minimize the risk of trade disputes by restricting payments to times of genuine market stress.

Balancing Domestic Support and Global Competition

The new legislative approach seeks to address both domestic needs and global trade concerns. Discussions have centered on structuring support systems that don't directly impact production levels. Tools like income-based assistance and improved risk management options, such as federal crop insurance, aim to strike a balance between helping U.S. farmers and maintaining fairness in international markets. Future policies are expected to focus on revenue-based support systems that provide aid during economic downturns without disrupting global competition.

These policy adjustments signal a shift toward market-driven solutions that protect farmers' incomes while reducing potential trade conflicts.

Resources for Cotton Producers

Producers need more than subsidies to thrive - they require dependable tools to manage production, locate gins, and stay updated on market and policy changes.

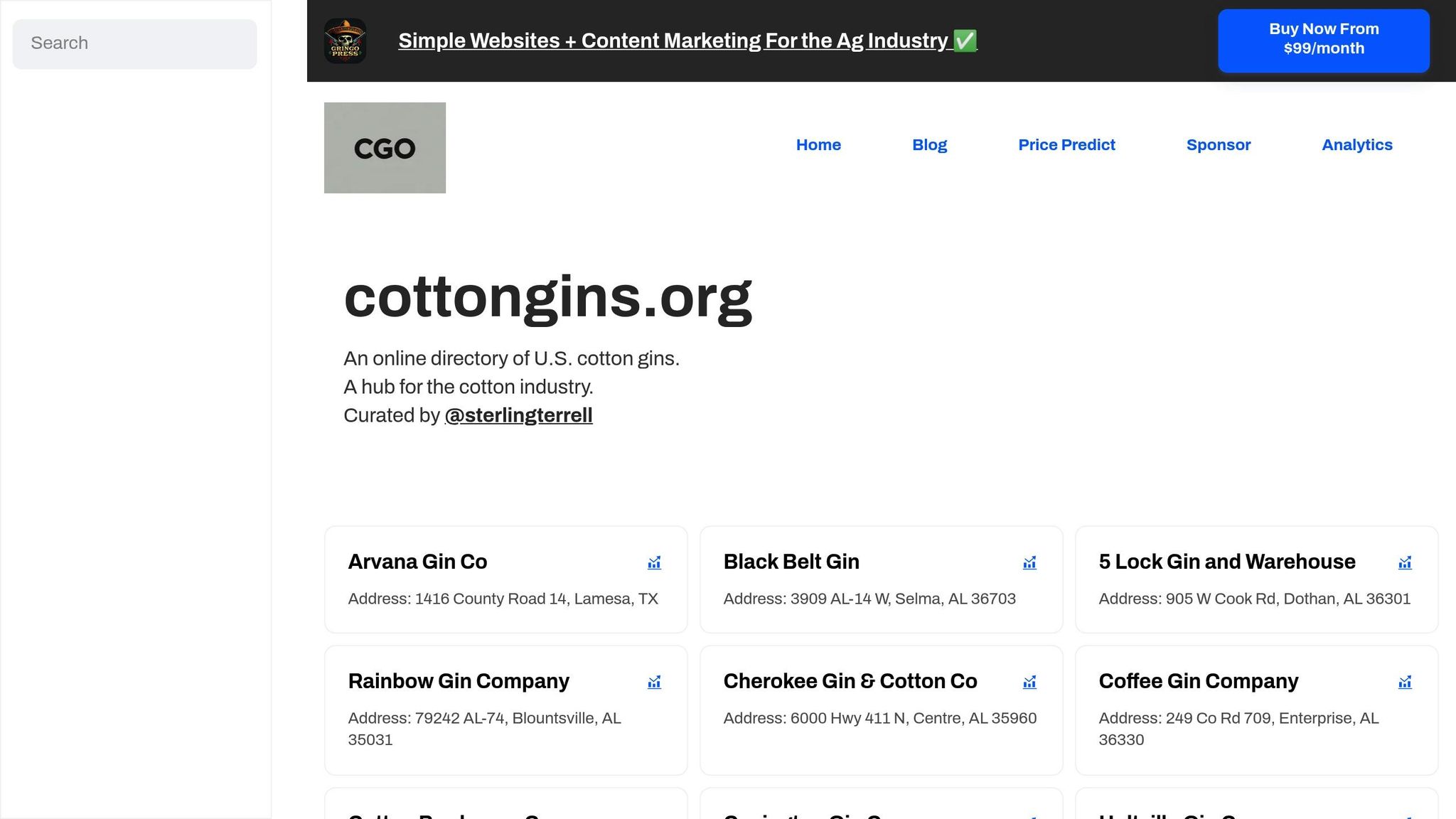

Exploring cottongins.org

The process of cotton ginning is a vital step in moving cotton from the field to the marketplace. Choosing the right gin can have a big impact on a producer's profitability. Cottongins.org acts as a comprehensive directory of U.S. cotton gins, helping producers find facilities in key cotton-growing states like Alabama, Arkansas, Arizona, California, Florida, Georgia, Louisiana, and Mississippi. This tool becomes especially valuable as producers adapt to shifting policies and market conditions.

With market fluctuations often tied to subsidy changes, having access to local support is essential. The website’s directory provides detailed information about cotton gins across the nation. For instance, listings include well-known facilities such as Arvana Gin Co in Lamesa, Texas, Black Belt Gin in Selma, Alabama, and Cherokee Gin & Cotton Co in Centre, Alabama. Additionally, cotton gin owners can increase their reach by using the "Submit A Gin" feature to add new facilities to the directory, ensuring it stays as current and useful as possible.

In an industry heavily influenced by policy changes, having access to an updated directory is crucial for making informed decisions. The platform also offers sponsorship opportunities to boost visibility for businesses within the cotton sector. Producers can further benefit from the site’s newsletter subscription, which delivers timely updates, blog posts, and insights into industry trends, including potential shifts in subsidy policies that could impact their operations.

Conclusion: Key Points

Federal cotton subsidies create ripple effects that disrupt both domestic and international markets. By altering the natural balance of supply and demand, these programs allow U.S. producers to sell cotton at prices that wouldn't be sustainable in an open, unsubsidized market.

On the home front, the benefits for American farmers are undeniable. Subsidies help minimize financial risks and provide the stability needed for long-term planning. This support has been crucial in keeping cotton production viable in areas where it might otherwise decline, helping sustain rural economies and the agricultural infrastructure that supports them. But these advantages come with a cost on the global stage.

U.S. subsidies drive lower global cotton prices, making it harder for farmers in developing countries to compete. This imbalance has sparked trade disputes, including notable cases brought to the World Trade Organization by countries like Brazil, which successfully challenged U.S. cotton subsidy programs.

Looking ahead, policymakers face a tough challenge: finding a way to support domestic producers while promoting fair competition in global markets. While recent farm bills have aimed to reduce trade distortions, the core conflict remains. Striking the right balance will require weighing the economic needs of American cotton farmers against the broader consequences for international trade and market fairness.

FAQs

How do U.S. cotton subsidies affect global cotton prices and farmers in developing countries?

U.S. cotton subsidies lead to overproduction, driving down global cotton prices by saturating the market with artificially low-cost exports. This has serious consequences for farmers in developing nations, especially in parts of Africa, where local growers find it hard to compete with subsidized U.S. cotton.

Falling market prices hit these farmers' incomes hard, often deepening poverty. This ripple effect can destabilize local economies and stifle opportunities for long-term growth in agricultural communities.

How have recent U.S. farm bills addressed global trade concerns about cotton subsidies?

Updates in U.S. Farm Bills and Cotton Subsidies

Recent U.S. farm bills, including the 2024 Farm Bill, have introduced adjustments aimed at addressing global trade concerns linked to cotton subsidies. These changes focus on refining subsidy programs to make them more precise and aligned with international trade agreements, reducing the risk of market disruptions.

The legislation also emphasizes fostering fairer trade practices and creating new export opportunities for U.S. cotton producers. While reforms are still in progress, these measures demonstrate a commitment to balancing domestic agricultural support with global trade responsibilities, contributing to improved market stability and easing international trade tensions.

How do subsidies impact cotton prices and production in the U.S.?

Subsidies have a big impact on how cotton prices and production levels are shaped in the U.S. Price-based subsidies, such as direct payments or price supports, make cotton farming more profitable. This increased profitability often leads to overproduction, which can push global cotton prices down by about 10% to 12%.

On the other hand, non-price-based subsidies, like crop insurance and export incentives, also contribute to surplus production. These types of support can skew market signals, leading to lower prices and an oversupply of cotton on the global stage. While these policies certainly help domestic producers, they often disrupt trade balance and create inefficiencies in the international cotton market.