Shipping cotton internationally can be tricky. Mistakes in paperwork, misclassifying goods, or ignoring regulations can lead to delays, fines, and higher costs. For instance, failing to file an Importer Security Filing (ISF) on time could cost you $5,000, while an intensive customs exam might delay your shipment by 10–20 days and add $1,500–$3,000 in fees. Proper preparation is key to avoiding these pitfalls.

Key Takeaways:

- Use precise HTS codes to avoid misclassification issues and incorrect duty rates.

- Ensure all documents, like Commercial Invoices and Certificates of Origin, are accurate and complete.

- Partner with experienced customs brokers to simplify compliance and reduce costs.

- Leverage automation tools like the ACE system for faster processing and error reduction.

- Stay updated on U.S. regulations for cotton imports, including labeling and pest control requirements.

The Customs Clearance Process: A Comprehensive Guide

Common Problems in Cotton Customs Clearance

Navigating customs clearance for cotton shipments can be tricky. The most common issues arise from regulatory compliance failures, documentation errors, and unexpected costs. These challenges can disrupt schedules and inflate expenses, making it vital to understand the specific hurdles involved.

Regulatory Compliance Problems

One of the key stumbling blocks is using incorrect classification codes. Many importers mistakenly rely on the global 6-digit HS code instead of the U.S.-specific 10-digit HTS code. This small oversight can lead to delays, incorrect duty rates, and issues with quota eligibility. The additional digits in the HTS code are critical because they determine the precise duty assessments.

Cotton quality standards add another layer of difficulty. Shipments must align with the Official Cotton Standards of the United States, covering factors like color grade, leaf grade, staple length, and micronaire. If you're pursuing a Form A determination, it's essential to use samples drawn by a licensed warehouseman. Samples from unlicensed facilities invalidate the classification request entirely. Additionally, these samples must meet specific weight and size requirements to be considered valid.

Missing or Incorrect Documentation

Documentation errors are one of the most frequent causes of customs delays. Mistakes in paperwork can result in shipment holds, border rejections, or even confiscation. Customs officials expect precise descriptions of goods. For example, instead of a vague label like "cotton blouse", documentation should specify, "Women's 100% cotton woven blouse."

"If the documents are selected for a check by customs, that is one of the first things they will point out. They need to identify the product and if the description is one simple description or is a generic description... then obviously that causes delays." – Jamie Craig, Customs Consultant, WTA Group

Missing Certificates of Origin can also lead to missed opportunities for preferential duty rates under trade agreements like USMCA. Furthermore, records supporting these certificates must be kept for at least five years. Errors in critical documents like the Bill of Lading or missing Manufacturer/Shipper Identification (MID) codes are frequent culprits behind entry summary rejections. In some cases, inaccurate declarations can lead to fines of up to $2,500 per incorrect filing.

While compliance and documentation issues are major concerns, unexpected costs can add another layer of complexity.

Unexpected Costs and Delays

Mistakes in duty calculations can be costly. If you discover an error, it’s crucial to report it within 90 days to avoid penalties. Using the wrong HTS code might result in paying an incorrect duty rate, leading to retroactive bills with interest and potential fines for negligence. Physical inspections also create delays, especially when shipments lack detailed information or fail to meet regional compliance standards. Cotton traded based on vendor self-declarations or buying dockets without proper traceability often faces heightened scrutiny, further delaying the process.

These challenges underline the importance of meticulous preparation and attention to detail when dealing with customs clearance for cotton shipments. Each misstep can lead to delays, fines, or additional costs, making it essential to address these common pitfalls proactively.

U.S. Regulatory Requirements for Cotton Imports and Exports

Navigating U.S. regulations - covering classification codes, labeling, and pest control - is essential to avoid delays and unexpected costs. Getting these details right can streamline customs clearance and keep your operations running smoothly.

HTS Classification and Tariff-Rate Quotas

Raw cotton must be classified under the Harmonized Tariff Schedule of the United States (HTSUS) to determine its quota status and applicable duty rates. This classification process is critical because it affects whether your shipment qualifies for reduced tariff rates under Tariff-Rate Quotas (TRQs). Once the TRQ limit is exceeded, any additional shipments are subject to much higher duty rates.

Accuracy in classification is non-negotiable, as U.S. Customs and Border Protection (CBP) has the final say on duty rates and classifications. To ensure clarity, you can submit a binding classification ruling electronically through the eRulings system before shipping. CBP typically issues rulings within 30 calendar days, but more complex cases may take up to 90 days.

You can also consult the Customs Rulings Online Search System (CROSS) for rulings on similar cotton products. For textile items subject to Tariff Preference Levels, it's important to confirm the correct three-digit textile category number, calculate Square Meter Equivalents (SME) accurately, and monitor the weekly Commodity Status Report to track quota fill rates. These steps ensure your documentation and labeling are aligned with regulations.

FTC and CBP Labeling Requirements

Imported textile products must comply with the Textile Fiber Products Identification Act (15 U.S.C. 70-70k) and Federal Trade Commission (FTC) rules. Labels need to list generic fiber names and percentages (5% or more), arranged in descending order. Fibers under 5% should be labeled as "other fiber(s)" unless they serve a specific function, such as 4% Spandex for elasticity.

If your product is "100% Cotton", it must contain no other fibers, excluding trims or ornamentation. For premium cotton types like Pima or Egyptian, the label must accurately reflect the fiber content, specifying the percentage in blends if mentioned by name.

Country of origin disclosure is another key requirement. The label must indicate where the product was processed or manufactured, as determined by CBP laws. Additionally, the manufacturer, importer, or responsible business must be identified using either the full company name or a Registered Identification Number (RN) issued by the FTC. Ensure all labels are securely attached and accurate before the goods reach the U.S. border. If CBP finds labeling errors without fraudulent intent, you may request to relabel the merchandise under customs supervision to avoid seizure. However, failure to comply with CBP demands to return non-compliant goods can lead to liquidated damages equal to the merchandise's entered value plus estimated duties. Proper labeling is just as critical as meeting any other regulatory standard.

APHIS Quarantine Regulations and De Minimis Rules

In addition to classification and labeling, it's vital to understand the USDA Animal and Plant Health Inspection Service (APHIS) quarantine regulations. To prevent pests like the pink bollworm from entering the U.S., APHIS restricts the entry of cotton lint, linters, waste, and seed cotton. Importers must secure permits before shipping, specifying whether the cotton is compressed or compressed to high density.

At certain ports, cotton may require vacuum fumigation or transfer to approved mills. If fumigation facilities aren't available, transportation in bond must be arranged. Submitting APHIS permits before shipment departure is crucial to avoid entry refusal.

For smaller shipments, the Section 321 de minimis rule allows duty-free entry for shipments with a fair retail value of $800 or less. This can be a cost-saving opportunity for certain cotton products. However, be mindful of interest charges on late duty payments, as they apply to delinquent amounts if not paid by the due date.

Required Documentation for Smooth Customs Clearance

Getting your paperwork right is key to avoiding delays at customs. U.S. Customs and Border Protection (CBP) requires specific documents to verify the contents, value, and origin of your shipment. Missing or incomplete documentation can lead to setbacks, so precision is non-negotiable. This paperwork is your ticket to compliance with the strict U.S. regulations mentioned earlier.

Commercial Invoice and Packing List

The Commercial Invoice and Packing List are the backbone of your customs documentation. Together, they provide essential shipment details.

The commercial invoice is critical for customs clearance. It must include:

- Shipper and consignee information

- Purchase order and invoice reference numbers

- A detailed description of the products

- Quantities, total value, and country of origin

- The correct Harmonized Tariff Schedule (HTS) code

Some shipments may also require an original blue-ink signature to differentiate the document from photocopies. The packing list, on the other hand, complements the invoice by listing the contents of each package. It should detail item descriptions, piece counts, weights, dimensions, and packaging types (e.g., crates or bales).

"The importer is responsible for exercising reasonable care concerning the accuracy of all documentation submitted to CBP." - U.S. Customs and Border Protection

Accuracy is crucial because mistakes can be costly. CBP may impose penalties of up to $100,000 per file for deliberate errors or failure to provide requested records. Additionally, you must retain entry records, including invoices and packing lists, for five years to comply with post-entry audits.

Certificate of Origin and Fiber Content Declarations

The Certificate of Origin (COO) is another essential document, especially for shipments of cotton or textile products. It confirms the origin of the goods, which can qualify them for tariff benefits. For textiles, some countries require a COO issued directly by the manufacturer. If you're claiming benefits under a Free Trade Agreement, you can often self-certify instead of obtaining third-party certification.

Fiber content declarations also need to be exact. For example, instead of vague terms like "textiles", use specific descriptions like "100% cotton" or "60% cotton, 40% polyester." These details help customs officials determine the correct duty rate. The fiber content listed on shipping documents must match the permanent labels sewn into the products.

Bill of Lading and Advance Shipping Notices

Once your invoices and certificates are ready, you’ll need proper shipping documents to finalize your set.

The Bill of Lading (BoL) is both a contract and a receipt for your shipment. It must include:

- Product descriptions, weights, and values

- Shipper and consignee details

- Container numbers and HTS codes

Errors in this document can lead to delays and fines.

For ocean shipments entering the U.S., an Importer Security Filing (ISF-10) must be submitted at least 24 hours before the vessel departs for a U.S. port. This filing includes information like:

- Seller and buyer names

- Importer of record number

- Country of origin

- HTSUS classification

All manifest data should be submitted electronically through the Automated Commercial Environment (ACE) system. Entry documents must be filed within 15 calendar days of the shipment’s arrival at a U.S. port, and estimated duties must be deposited within 10 working days of entry. Submitting your documents to your customs broker early can help you avoid costly demurrage charges.

sbb-itb-0e617ca

How to Avoid Delays and Reduce Costs

Speeding up customs clearance and cutting expenses requires a mix of knowledgeable partnerships and smart use of digital tools.

Work with Experienced Customs Brokers

Partnering with a licensed customs broker who specializes in agricultural products can save both time and money. They ensure accurate HTS classification, helping you avoid expensive misclassifications.

Brokers also handle duty drawbacks and can utilize Foreign Trade Zones (FTZ) to postpone payments and lower landed costs. For example, in 2025, Legacy SCS collaborated with Randa in Northern Nevada as FTZ 126 Administrator, reducing costs while improving supply chain transparency. By leveraging digital systems, brokers can process documentation quickly, secure customs bonds in under an hour, and adapt to regulatory updates like the ACE Portal's electronic refunds mandate.

Use Automation Tools for Compliance and Tariff Code Lookup

Automation tools simplify compliance processes. The Automated Commercial Environment (ACE) acts as a centralized hub for managing accounts, responding to CBP forms, generating compliance reports, and filing protests.

"CBP applies expertise, technology, and automation to create streamlined and efficient processes to facilitate the global exchange of safe and legitimate goods." - U.S. Customs and Border Protection

The eRulings program lets businesses submit electronic requests for binding HTS classification rulings, providing legal certainty for upcoming shipments. CBP typically issues these rulings within 30 calendar days. ACE Reports also allow for large-scale compliance audits, processing up to 2 million rows of data to identify and fix systemic issues before they escalate.

For exporters, the Electronic Export Manifest (EEM) system reduces manual errors and improves data management. With near real-time inspection notifications, businesses can quickly address any issues. Combining these tools with pre-classification of goods can help resolve potential classification challenges before shipment.

Pre-Classify Goods and Obtain Advance Rulings

Pre-classifying goods ensures smoother customs clearance. By requesting a binding CBP ruling on HTS classification, origin, or trade program eligibility in advance, you gain legal clarity on how your goods will be treated during importation.

"Advance rulings provide the international trade community with a transparent and efficient means of understanding how CBP will treat a prospective import or carrier transaction." - U.S. Customs and Border Protection

To request a ruling, use the eRulings Template and submit it to the National Commodity Specialist Division (NCSD). Include detailed information such as a description of the goods, component materials, intended use in the U.S., and any supporting documents like photos or chemical analyses. Typically, you'll receive an acknowledgment and a binding ruling control number within one business day.

For cotton products, CBP’s Informed Compliance Publications like "Classification and Quota Status of Raw Cotton" can provide additional guidance. You can also search the Customs Rulings Online Search System (CROSS) to find rulings on similar products, which can speed up your own classification process. Once you have your ruling, include the control number with your entry documents to ensure consistent treatment during importation.

Cost-Saving Tips and Best Practices

U.S. Cotton Import Entry Types: Cost and Requirements Comparison

Cutting down customs clearance costs boils down to picking the right entry type, ensuring flawless documentation, and tapping into expert knowledge.

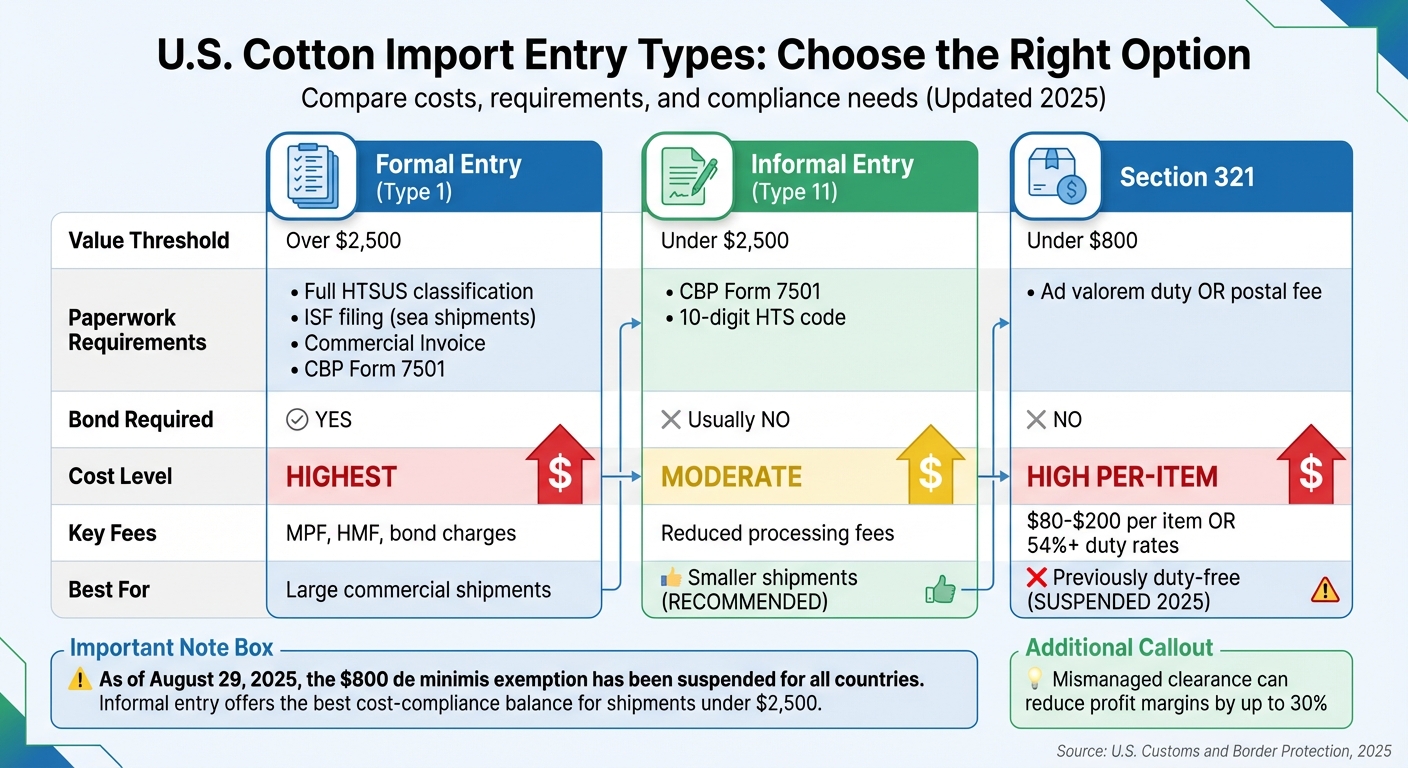

Compare Entry Types: Formal, Informal, and Section 321

Your choice of entry type can significantly affect your expenses. Since August 29, 2025, the U.S. has suspended the de minimis exemption for all countries, removing the $800 duty-free threshold. This change has made the entry process more complicated and costly, even for low-value shipments.

| Entry Type | Value Threshold | Paperwork Requirements | Bond Required? | Cost Implications |

|---|---|---|---|---|

| Formal (Type 1) | Over $2,500 | Full HTSUS, ISF (sea), Commercial Invoice, CBP Form 7501 | Yes | Highest costs; includes fees like MPF, HMF, and bond charges |

| Informal (Type 11) | Under $2,500 | CBP Form 7501, 10-digit HTS code | Usually No | Moderate fees; ideal for smaller shipments |

| Section 321 | Under $800 | Ad valorem duty or postal fee | No | High per-item fees ($80–$200) or duty rates exceeding 54%, depending on origin |

For shipments valued under $2,500, informal entry offers the best mix of cost and compliance. While it requires a 10-digit HTS code and CBP Form 7501, it avoids the bond and higher fees tied to formal entry. Mismanaged clearance processes can cut profit margins by up to 30% due to unnecessary surcharges.

"Transparent landed cost pricing is no longer a 'nice-to-have' - it's a competitive necessity for selling into the U.S. market."

- Shane Bogdan, Director of Cross-Border Sales, Avalara

But choosing the right entry type is just the start - accurate documentation is just as crucial.

Verify Compliance Before Shipment

Double-check all cotton shipment documentation before sending it out to steer clear of expensive delays at the border. The importer of record is ultimately responsible for ensuring all paperwork is accurate and for paying any duties, taxes, and fees - even when using a licensed customs broker.

Mistakes like incorrect fiber content declarations or missing country-of-origin details can lead to reclassifications, which often result in much higher duty rates. Proper documentation is your best defense against these costly issues.

"The actual duty rate of the item you import may not be what you think it should be as a result of your research. CBP makes the final determination."

- U.S. Customs and Border Protection

Pay close attention to fiber composition (natural vs. synthetic), the country of origin for raw materials, and the product's intended use in the U.S. Reach out to the CBP import specialist at your port of entry for guidance on commodity-specific requirements and advisory duty rates. For complex items, consider requesting a Binding Ruling from CBP to lock in a legally binding duty rate before importing.

Keep in mind that importers must cover all costs related to CBP cargo inspections, including transportation to Centralized Examination Stations, storage, and unloading fees - costs that can add up to several hundred dollars per shipment. Verifying everything beforehand can help you avoid triggering these inspections.

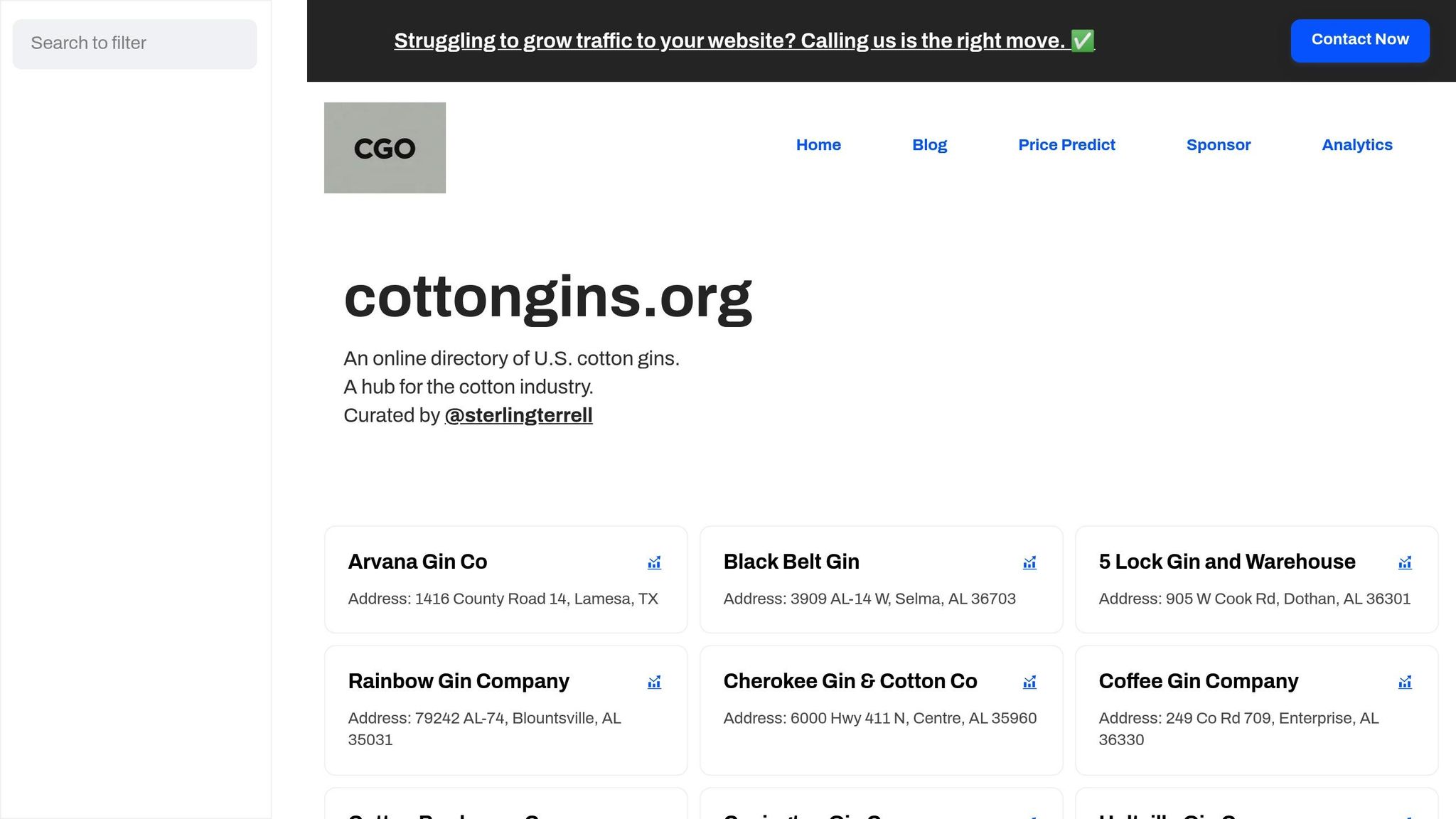

Partner with cottongins.org for Local Expertise

Once you've selected the right entry type and verified compliance, working with local experts can further trim unexpected costs. Correctly classifying items under the Harmonized Tariff Schedule (HTS) requires years of specialized knowledge. Factors like fiber content, assembly location, and garment details (e.g., darts) all play a role in determining the correct duty rate.

"Experts spend years learning how to properly classify an item in order to determine its correct duty rate."

- U.S. Customs and Border Protection

cottongins.org connects businesses with seasoned professionals in the U.S. cotton industry who understand these nuances. These experts can assist with requesting Binding Rulings, navigating the Automated Commercial Environment (ACE) for efficient reporting, and conducting internal audits using ACE Reports to catch errors before they lead to penalties.

Collaborating with local specialists ensures compliance with U.S. customs regulations and helps meet "Reasonable Care" standards under Informed Compliance. General information forums often fall short of these requirements. With strict deadlines like filing Cargo Release within 15 calendar days of arrival and Entry Summary within 10 working days, having expert support ensures you stay on track.

As CBP moves to mandatory electronic refunds via the ACE Portal starting February 6, 2026, experienced partners can also help you enroll in ACH refunds and navigate these digital changes.

Conclusion

Navigating cotton customs clearance successfully hinges on solid preparation, strict compliance, and leveraging expert advice. Ensuring all required documents are in order is key to avoiding costly reclassifications or delays.

Take advantage of the Automated Commercial Environment (ACE) to simplify the clearance process and address compliance challenges proactively. With U.S. Customs and Border Protection (CBP) transitioning to electronic refunds through the ACE Portal starting February 6, 2026, enrolling in Automated Clearinghouse (ACH) will ensure your financial transactions remain seamless. This shift underscores the importance of combining technology with specialized knowledge.

Partnering with skilled customs brokers and industry experts is essential for handling complex Harmonized Tariff Schedule (HTS) classifications. Incorrect classifications can lead to higher duty rates and hefty penalties.

"CBP's Trade programs apply expertise, technology, and automation that not only creates streamlined and efficient processes to facilitate the global exchange of safe and legitimate goods, but also minimizes cost and provides certainty, transparency, and predictability to members of the trade community." - U.S. Customs and Border Protection

Local resources, such as cottongins.org, can further enhance your strategy by ensuring accurate classifications and timely documentation. They can assist with requesting Binding Rulings to lock in duty rates ahead of imports and perform internal audits using ACE Reports. By combining thorough preparation, digital tools, and expert guidance, you can transform customs clearance into a strategic advantage.

FAQs

What are the most common documentation mistakes in cotton customs clearance, and how can they be avoided?

Mistakes in documentation during cotton customs clearance are a frequent source of headaches. Inaccurate or incomplete paperwork can lead to delays, fines, or even the seizure of shipments. Common errors include misclassifying goods, using the wrong tariff codes, or providing vague descriptions of the cotton being shipped. Customs officials require precise information, so even minor slip-ups can throw the entire process off track.

Another issue often encountered is the failure to meet specific regulatory requirements. Missing certificates of origin, incorrect labeling, or not adhering to U.S. import rules are typical culprits. These missteps can result in shipments being held at the border, driving up costs and causing unnecessary delays.

To steer clear of these problems, it's important to double-check all documentation for accuracy, stay updated on the latest regulations, and consider tools like automation or the assistance of experienced customs brokers. These steps can help ensure a smoother customs clearance process.

How do automation tools like ACE help speed up customs clearance for cotton trade?

Automation tools such as ACE (Automated Commercial Environment) take much of the hassle out of customs clearance by automating data submissions and cutting down on manual entry. This not only reduces errors but also ensures compliance with U.S. Customs and Border Protection (CBP) regulations, helping to secure faster approvals.

Through improved communication with CBP and seamless integration with other systems, ACE allows businesses to handle shipments more efficiently. This can help prevent delays and reduce costs tied to penalties or storage fees. Using tools like ACE can play a key role in keeping your cotton trade operations running without unnecessary hiccups.

Why is pre-classifying goods important for customs clearance?

Pre-classifying goods ensures you use the right tariff codes, helping you avoid expensive delays, fines, or even shipment rejections during customs processing. By determining the correct classification ahead of time, you can smooth out the clearance process and minimize the chance of unexpected problems.

Taking this step also helps you stay compliant with regulations, making it easier to calculate duties and taxes more precisely. In the end, pre-classification saves time, cuts costs, and makes your cotton trade operations run more efficiently.