For cotton farmers navigating the razor-thin margins of a 1,200-lb/acre operation, where input costs can devour 60-70% of gross revenue and a single audit can unravel years of equity, mastering tax strategies for cotton farmers isn't just smart—it's survival. Seasoned producers, who've weathered basis crushes and drought declarations alike, understand that the IRS code brims with ag-specific levers to defer liabilities, accelerate depreciation, and reclaim 20-30% more after-tax income through targeted maneuvers. Unlike generic filings that leave money on the table, these tax strategies for cotton farmers layer Section 179 expensing with crop insurance reimbursements, fortifying balance sheets against volatility without the overhead of consultants. Drawing from longstanding extension advisories and IRS Pub 225 guidelines, this deep dive equips you to audit your Schedule F line-by-line, optimizing for everything from equipment buys to conservation easements. Whether stacking LDP payments or amortizing orchard resets, effective tax strategies for cotton farmers can net $50-100/acre in preserved capital, funding the next varietal trial or pivot upgrade. Pair this with our risk management strategies for cotton farming post to align fiscal shields with operational buffers.

Core Deductions: Fueling Efficiency Through Everyday Expenses

At the heart of tax strategies for cotton farmers lie ordinary and necessary deductions under IRC Section 162, reclaiming costs from seed to storage that often total 40-50% of outlays. Fuel and repairs on tractors topping 100 PTO hp? Deduct 100% in the year incurred if under de minimis safe harbors ($2,500/item), sidestepping capitalization traps that delay relief.

For irrigation pivots spanning 500 acres, allocate repairs via units-of-production methods, prorating based on irrigated acres to match revenue streams—essential for variable-rate setups where efficiency gains 15-20% water savings. Home office deductions extend to farm managers logging mileage at 67 cents/mile (standard rate), but veterans calibrate via actual expenses for barns doubling as storage, claiming 50% of utilities if square footage qualifies.

- Seed and Fertilizer Write-Offs: Direct expense variable inputs like PGRs or micronutrients; for prepaids exceeding 50% of prior-year use, defer to match crop years, avoiding bunching that spikes brackets.

- Labor Allocations: W-2 wages for seasonal crews get full deduction, but track subcontractor 1099s meticulously—misclassifications invite penalties up to 40% of unpaid taxes.

- Pro Tip: Use Form 4562 for substantiation; digital logs via apps streamline audits, preserving 10-15% more via precise allocations.

These foundational tax strategies for cotton farmers ensure cash flow mirrors field realities, not calendar quirks.

Accelerated Depreciation: Capitalizing on Equipment Investments

Heavy hitters in tax strategies for cotton farmers revolve around depreciation, where bonus provisions under Section 168(k) allow 80% immediate write-offs on new planters or module builders through 2026—phasing to 60% thereafter, per CARES Act extensions. For a $300k cotton picker, this slashes taxable income by $240k upfront, freeing capital for debt service at 5-7% rates.

Section 179 caps at $1.22 million (2025 indexed), phasing out above $3.05 million in assets, ideal for bundling GPS retrofits with harrow upgrades. Bonus applies to used gear too, but qualify via placed-in-service rules—vital for mid-season trades that keep fleets humming without idle depreciation drags.

| Asset Type | Eligible Bonus % | Section 179 Limit | MACRS Recovery Period | Key Consideration |

|---|---|---|---|---|

| Tractors >40 hp | 80% | Up to $1.22M | 5 years | Fuel efficiency upgrades qualify separately |

| Irrigation Systems | 80% | Included in cap | 7 years | Drip lines amortize over useful life if custom |

| Storage Modules | 60% (if qualified) | Partial | 7 years | Tarps and wraps as supplies, not capital |

| Software (Precision Ag) | 100% | Full | 3 years | Cloud-based VRA tools expensed immediately |

Veterans layer these in tax strategies for cotton farmers by timing purchases pre-year-end, stacking with LIFO inventory for seed stocks to minimize COGS inflation.

Crop Insurance and Disaster Relief: Shielding Against Yield Shortfalls

When fusarium fells 20% of bolls or hail shreds canopies, tax strategies for cotton farmers pivot to insurance integrations, where premiums deduct as business expenses while claims flow tax-free up to basis—reimbursements offset prior-year losses via NOL carrybacks up to five years, per TCJA mods.

For MPCI policies at 75% coverage, elect harvest price exclusion to lock higher futures, deducting premiums against projected revenue. Disaster credits under Section 45B amplify: Up to $100/acre for qualified droughts, stacking with ARC/PLC benchmarks for double-dip protection without clawbacks.

- Claim Timing: Report in the disaster year for immediate offsets; defer if carryforwards preserve lower brackets.

- Conservation Tie-Ins: Pair with EQIP grants—non-taxable but deductible implementation costs like cover crop seeding.

- Audit Safeguard: Maintain APH histories; discrepancies trigger 20% accuracy penalties.

These resilient tax strategies for cotton farmers convert calamities into fiscal rebounds, sustaining 10-20% equity growth post-event.

Income Averaging and Deferrals: Smoothing Revenue Peaks and Valleys

Volatility defines cotton—$0.70/lb booms yielding $800/acre nets versus $0.50 slumps at break-even—so tax strategies for cotton farmers harness Schedule J averaging, blending current income over three prior years to dodge 37% brackets on spike seasons.

For LDP or marketing loan gains, elect accrual accounting to defer recognition until sales, aligning with cash basis filers who dominate ag (95% per IRS stats). Installment sales on land parcels spread capital gains at 15-20% rates, with like-kind exchanges under 1031 preserving basis for reinvestment in adjacent fertility.

Commodity wage deferrals via deferred comp plans shelter 20-30% of operator draws, vesting post-retirement to leverage 12% brackets. For co-op patrons, patronage dividends deduct as costs of goods, reducing taxable patronage by 100%.

Implementation in tax strategies for cotton farmers: Model via tax software projecting brackets; a 30% averaging drop can save $15k on $100k swings.

Conservation and Sustainability Incentives: Green Gains for Soil Stewards

As stewards of loamy deltas yielding 1,500 lbs/acre, tax strategies for cotton farmers tap Section 175 deductions for soil/water conservation—up to 25% of gross farm income annually, carrying forward indefinitely for terracing or no-till transitions that curb erosion 40-50%.

Easement donations under 170(h) yield FMV deductions at 50% AGI limits, ideal for marginal acres swapped for perpetual protections, offsetting gains from equipment sales. Biofuel credits via 40A extend to gin trash conversions, claiming $1/gallon equivalents for on-farm digesters.

- CRP/CPACE Enrollments: Annual payments tax-free if conservation-motivated; deduct setup costs like fencing.

- Carbon Sequestration: Emerging 45Q credits at $50/ton CO2 stored via enhanced rotations, stacking with EQIP reimbursements.

- Best Practice: Document via NRCS plans; audits favor quantified benefits like 10-15% SOC uplifts.

These eco-aligned tax strategies for cotton farmers not only green your ledger but qualify premiums from buyers chasing B Corp certifications.

Estate and Succession Planning: Preserving Legacy Across Generations

For multi-gen outfits spanning 2,000 acres, tax strategies for cotton farmers extend to gifting via annual exclusions ($18k/recipient) and 529 plans for heirs' ag ed, minimizing estate taxes at 40% over $13.61M exemptions.

Family limited partnerships allocate discounts (20-40%) on contributed land, shifting appreciation outside estates while retaining control via GP interests. Buy-sell agreements funded by life insurance provide liquidity, with premiums deductible if structured as key-man policies.

- Basis Step-Ups: Time transfers pre-appreciation; 754 elections adjust partnership bases for successors.

- Charitable Remainder Trusts: Defer gains on timber sales tied to windbreaks, yielding income streams.

- Pro Tip: Annual valuations via appraisers; IRS challenges hinge on lack of contemporaneous docs.

Layered into tax strategies for cotton farmers, these secure transitions, averting forced liquidations that crater values 30-50%.

Record-Keeping and Compliance: Fortifying Against IRS Scrutiny

Ironclad records underpin all tax strategies for cotton farmers, with digitized ledgers via QuickBooks Ag editions tracking lot-specific inputs for 7-year retention. Substantiate via receipts geotagged to fields, preempting hobby loss disallowances under Section 183—profitable intent proven by business plans projecting 10-15% ROIs.

State conundrums like sales tax exemptions on ag inputs demand nexus filings; nexus trackers flag multi-state exposures. For pass-through entities, S-corp elections minimize SE taxes on 50% of net, but qualify via reasonable salaries.

- Audit Triggers to Dodge: Uniform losses without diversification; always pair with profit histories.

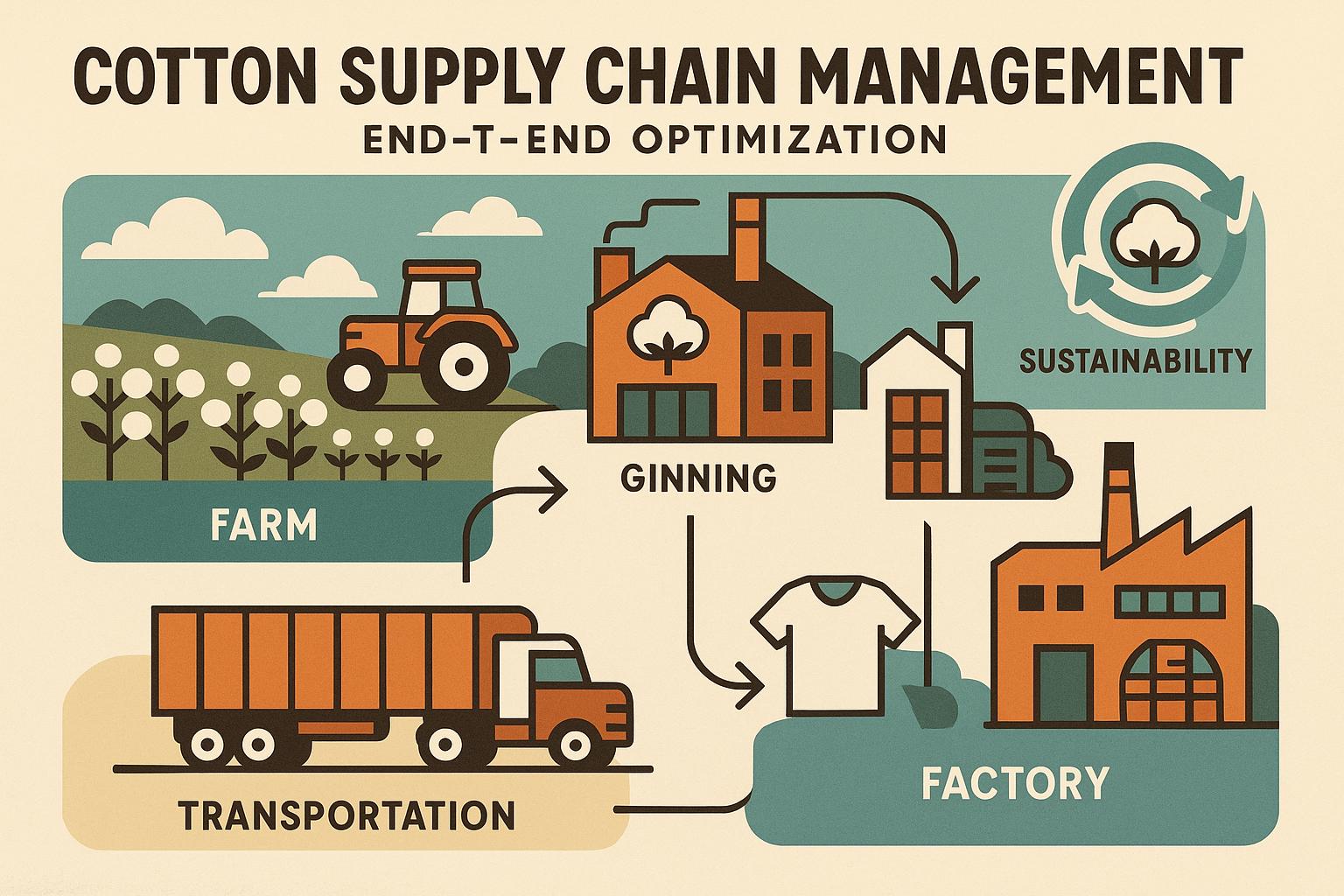

- Tech Aids: Blockchain for supply chain proofs, ensuring traceability for organic premiums.

- Annual Review: CPA stress-tests for AMT exposures, common in high-depreciation years.

Vigilance in tax strategies for cotton farmers averts 20% negligence penalties, safeguarding deductions.

Advanced Maneuvers: Leveraging Credits for Innovation and Expansion

Push boundaries with R&D credits under 41 for varietal trials—20% of qualified expenses like lab assays on fiber traits, stacking with energy credits for solar-pumped irrigation slashing bills 30-40%.

Opportunity zones defer gains on equipment sales by reinvesting in rural developments, with 15% basis steps after seven years. For organics, Section 1245 recapture exemptions on converted gear accelerate transitions.

| Credit Type | Benefit Rate | Eligible Expenses | Carryforward Period | Cotton Tie-In |

|---|---|---|---|---|

| R&D (41) | 20% | Trial costs | 20 years | Breeding programs |

| Energy (48) | 30% | Solar installs | N/A | Pivot electrification |

| Work Opportunity (51) | 40% first-year wages | Veteran hires | N/A | Seasonal labor |

| Fuel (40A) | $1/gal equiv. | Biodiesel use | 1 year | Tractor blends |

These cutting-edge tax strategies for cotton farmers fuel scalability, targeting 5-10% margin expansions.

Regional Nuances: Tailoring to Beltwide Realities

Customize tax strategies for cotton farmers by zone: Delta humidity qualifiers boost wetland credits, while Plains wind farms layer production tax credits atop cotton rotations. Texas franchise taxes demand apportionment tweaks for out-of-state sales.

Hurdles like varying state AGI add-backs? Federal overrides prevail. Expenses? Bundle with co-op filings for volume discounts.

Adaptations ensure precision.

In closing, wielding tax strategies for cotton farmers transforms compliance into a competitive edge—deduct boldly, depreciate swiftly, credit innovatively. Action steps: Inventory Q4 buys for bonus eligibility, model averaging scenarios, and consult Pub 225 quarterly. Benchmark against peers; what's your sharpest deduction?