Cotton farming is risky but essential for many growers. Crop insurance offers financial protection against weather-related losses like drought, hail, and hurricanes, with coverage options ranging from yield protection to revenue protection.

Weather data plays a key role in insurance decisions, helping farmers manage costs and insurers assess risks. By analyzing historical trends, monitoring real-time conditions, and using predictive models, farmers can make smarter choices about coverage. Tools like satellite imagery, soil moisture sensors, and local weather stations provide detailed insights that improve insurance planning.

Quick takeaways:

- Insurance types: Yield-based (MPCI) and revenue-based (RP) options.

- Weather risks: Drought, excessive rain, hail, temperature extremes, hurricanes.

- Data tools: Satellite imagery, soil monitoring, weather forecasts.

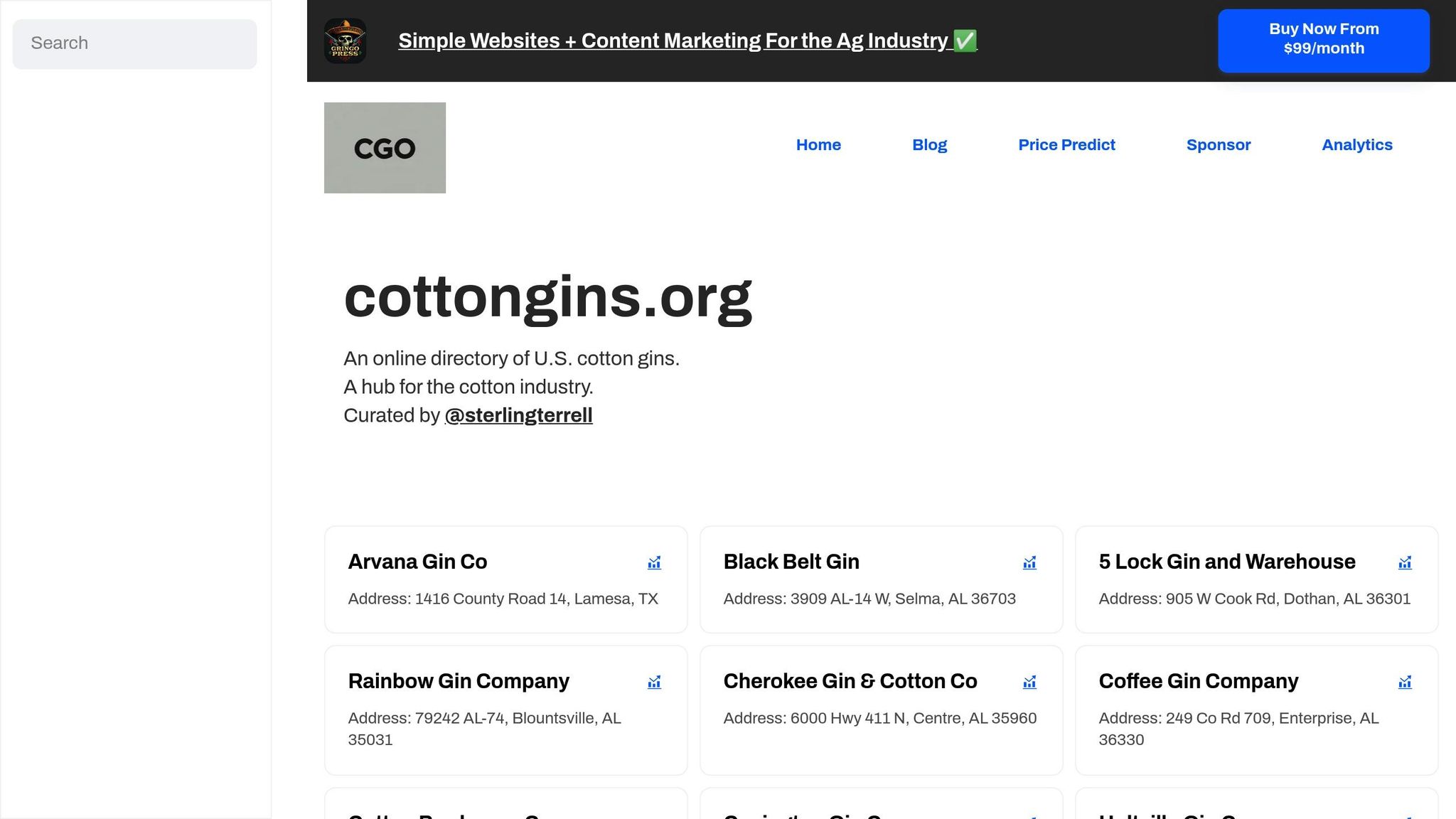

- Local resources: Platforms like cottongins.org help map infrastructure and weather risks.

Farmers who integrate weather data into their insurance strategies can better protect their crops and finances, ensuring stronger resilience against unpredictable conditions.

2023 USDA Fall Data Users' Meeting: The Use of Weather Information In Producing the WASDE

Weather Risks That Impact Cotton Production

Cotton farming is heavily influenced by weather, with various conditions posing risks throughout the growing season. Understanding these challenges is key to aligning insurance coverage with the realities farmers face.

Common Weather Threats to Cotton Farms

Drought is a major concern for cotton growers. Cotton needs plenty of water during its growing season, and prolonged dry spells can drastically lower yields and harm fiber quality. When soil moisture drops during critical growth stages, it often leads to boll shedding and reduced harvests. These conditions frequently result in quick insurance claims and adjustments to premiums.

Excessive rainfall can be just as problematic. Heavy rains during planting can delay seeding and create waterlogged soils, which hinder root development. At harvest time, too much rain interferes with picking and weakens fiber quality. These issues often require changes to insurance policies and terms.

Hailstorms are another serious threat. They can shred leaves, snap stems, and destroy developing bolls, leaving plants vulnerable to pests and disease. The physical damage from hail typically leads to immediate insurance claims and impacts future premium rates.

Temperature extremes also complicate cotton farming. Late spring frosts can kill young seedlings, forcing farmers to replant and delaying the growing season. On the other hand, high temperatures during flowering can cause boll shedding and lower fiber quality. Early fall freezes further disrupt the crop by preventing bolls from maturing. These temperature swings frequently lead to policy adjustments.

High winds and severe thunderstorms can physically damage cotton plants, knocking them over or breaking stems - a condition known as lodging. This not only complicates harvesting but can also trigger pest outbreaks. Insurers often track wind damage closely, as it creates specific claim categories.

Hurricanes are particularly devastating, combining strong winds, heavy rains, and flooding. These events can destroy entire fields and damage farm infrastructure, leading to some of the largest insurance payouts and influencing regional premium rates.

Past Weather Patterns and Insurance Claims

Historical weather data highlights the direct link between these risks and insurance claims. For example, droughts in major cotton-growing regions have caused significant yield losses, resulting in widespread claim activity and high payouts.

Tropical storms and hurricanes have also disrupted production, with flooding and structural damage to farms prompting substantial insurance responses. Similarly, spring flooding has delayed or prevented planting, increasing claims when farmers are forced to alter or cancel their schedules.

Unseasonal temperature swings have led to extensive replanting efforts, further driving up claims. Additionally, climate cycles like El Niño and La Niña play a role by shifting drought and rainfall patterns. When multiple adverse conditions hit in the same season, the risks multiply, emphasizing the importance of comprehensive insurance coverage for cotton growers.

How to Use Weather Data for Insurance Decisions

Making informed insurance decisions often hinges on analyzing weather data effectively. For cotton farmers, tapping into multiple weather data sources can safeguard their operations and even help reduce premium costs.

Gathering and Reviewing Weather Data

Historical weather data plays a key role in insurance planning. The National Weather Service, for example, offers decades of records on rainfall, temperature extremes, and severe weather events. By examining trends over ten years or more, cotton farmers can identify recurring patterns and assess potential risks.

Local weather stations provide even more targeted insights. Systems like the Automated Surface Observing System (ASOS) and Automated Weather Observing System (AWOS) deliver hourly updates on temperature, precipitation, wind speed, and humidity. With stations often located within 20–30 miles of farms, these networks offer highly relevant, localized data.

Soil moisture monitoring has become a game-changer. The U.S. Department of Agriculture’s Soil Climate Analysis Network (SCAN) supplies real-time data on soil temperature and moisture levels at various depths. This information helps farmers evaluate drought conditions and irrigation needs - critical factors when making insurance decisions.

Satellite imagery adds a broader perspective. Free resources from the National Oceanic and Atmospheric Administration (NOAA) provide precipitation estimates, drought monitoring, and vegetation health indices. These tools allow farmers to track current conditions and spot emerging trends.

Seasonal forecasts from the Climate Prediction Center round out this toolbox. These 3–6 month outlooks predict whether upcoming seasons will be wetter, drier, warmer, or cooler than average. For cotton farmers, such forecasts can inform adjustments to insurance coverage ahead of pivotal times like planting season.

Together, these data sources lay the groundwork for advanced tools that combine and analyze weather information in real time.

Technology Tools for Weather-Based Insurance Analysis

Modern farm management platforms have revolutionized how weather data is used in insurance planning. Tools like John Deere’s Operations Center and Bayer’s Climate FieldView integrate field-specific weather data with historical yield information. By analyzing how past weather events impacted specific fields, farmers can make smarter decisions about coverage levels.

Real-time alerts from mobile apps and software platforms allow farmers to adapt quickly as conditions change. Many of these tools merge historical yield data with live weather updates, offering a comprehensive view that supports better insurance planning.

Insurance companies are also stepping up with their own weather analysis platforms. These systems let farmers view weather data alongside their policies and often include risk calculators. By estimating potential losses based on current and forecasted conditions, these tools make it easier to evaluate coverage needs.

Precision sensors and AI-powered platforms add another layer of sophistication. These systems continuously collect and analyze weather data, enabling real-time adjustments to risk assessments and supporting proactive insurance decisions.

However, technology works best when paired with human judgment. While automated tools gather and process data, farmers must interpret this information in the context of their unique operations. Factors like soil type, irrigation systems, and management practices can make a significant difference in how weather impacts one farm compared to another.

Some farmers even use weather data strategically to time their insurance purchases. Policies bought during periods of favorable weather often come with lower premiums compared to those acquired during forecasts of severe conditions. By leveraging these insights, farmers can optimize both coverage and costs.

sbb-itb-0e617ca

Weather-Based Insurance Strategies

Cotton growers are turning to weather data to fine-tune their insurance coverage. By incorporating weather analytics, insurers can better predict risks and set premiums that align with the specific weather challenges of different regions.

This approach opens the door to creating insurance products that are specifically designed to address weather-related risks.

Weather-Specific Insurance Products

One example is rainfall-indexed insurance. This type of coverage uses precise precipitation data from local weather stations to determine payouts. If rainfall during critical growth periods drops below a set threshold, the policy is triggered. What makes this method stand out is that it relies on measurable weather data instead of subjective damage assessments, leading to quicker claim settlements and more straightforward policy terms.

Enhancing Risk Assessment with Weather Data

Historical weather data plays a key role in improving risk assessment. Insurers are now developing predictive models that go beyond just analyzing past yields. For instance, Bayesian analysis incorporates historical weather trends into these models, offering greater accuracy in forecasting yield and loss costs. These advanced models allow insurers to create coverage plans that are more precisely tailored to the unique risks faced by cotton producers in various locations.

Using cottongins.org for Local Resources

Understanding local infrastructure is a key part of managing weather risks effectively, especially when it comes to making decisions that impact your operations. When weather events threaten your cotton crop, knowing where the nearest cotton gin is located can make a big difference. Proximity to a gin can directly influence your efficiency and help you navigate weather-related challenges more effectively.

How cottongins.org Supports Cotton Producers

The cottongins.org directory offers a detailed list of cotton gins across major cotton-producing states like Alabama, Arkansas, Arizona, California, Florida, Georgia, Louisiana, Mississippi, and Texas. Each entry includes specific addresses, making it simple to locate facilities near your operations.

Having accurate gin location data helps map out regional infrastructure and provides valuable reference points for understanding local weather patterns. The platform also features a "Submit A Gin" tool, allowing users to add new entries. This community-driven approach ensures the directory stays up-to-date, giving you access to the latest information about cotton gin availability and supporting better planning for your production needs.

Using cottongins.org to Plan for Weather Risks

Combining local gin data with advanced weather insights can sharpen your risk management strategies. By tying gin locations to specific regions, you can align weather trends with local production capacity. This geographical context helps you assess how weather conditions might impact your crops and develop strategies tailored to your area.

The directory also reveals clusters of gins in certain counties, which can highlight localized weather risks, such as drought or heavy rainfall. By integrating this information with historical weather data, you can create more precise contingency plans, ensuring you're better prepared for potential weather-related disruptions. This targeted approach can make your risk management efforts more effective and your operations more resilient.

Conclusion

Weather impacts on cotton production are undeniable, and using advanced data tools can significantly improve risk management strategies. Weather data plays a key role in making informed insurance decisions, helping producers understand how weather extremes affect their crops and enabling them to build stronger protection plans.

By analyzing historical weather patterns, growers can identify long-term risks, while real-time monitoring systems provide critical insights during the growing season. Tools like satellite imagery, weather stations, and predictive analytics make this information easier to access and act on than ever before.

Regional insights, such as those from local gin data provided by cottongins.org, offer valuable context by highlighting production trends during specific weather events. Combining this regional knowledge with weather data analysis creates a clearer picture of the risks unique to each operation.

As weather-specific insurance products continue to expand, cotton producers have more options to safeguard their livelihoods. Whether it’s drought in West Texas, hurricanes along the Gulf Coast, or hailstorms in the Mid-South, a well-balanced plan that includes federal crop insurance and supplemental coverage can mean the difference between enduring a tough season and facing financial challenges.

The most successful producers view weather data as an ongoing priority. Regular monitoring and thoughtful planning - based on both historical trends and current forecasts - help create operations that are better equipped to handle unpredictable weather. Staying informed and proactive ensures a stronger foundation for navigating the challenges ahead. This comprehensive approach helps cotton growers build resilience and secure their future.

FAQs

How can using weather data improve cotton crop insurance for farmers?

Weather data plays a crucial role in cotton crop insurance, offering farmers a way to navigate the challenges of unpredictable weather - whether it’s drought, flooding, or storms - that can severely impact yields. By leveraging this data, farmers can access insurance policies specifically designed to address the climate risks unique to their region.

This tailored protection doesn’t just safeguard crops; it also provides financial stability. With reduced uncertainty, farmers are more confident investing in their operations. Plus, effective risk management allows cotton growers to concentrate on maintaining resilient and sustainable production practices, even when weather conditions take a turn for the worse.

What types of weather-related insurance options are available for cotton farmers, and how do they help?

Cotton farmers in the U.S. have several insurance options to safeguard their crops from unpredictable weather. Among the traditional choices are Catastrophic Risk Protection (CAT), Yield Protection, and Revenue Protection. These plans, managed by the USDA Risk Management Agency, provide coverage for losses caused by extreme weather events.

Another option gaining traction is weather index insurance. Instead of relying on field inspections, this type of insurance uses weather data - like rainfall, temperature, or frost levels - to trigger payouts when specific thresholds are reached. It's particularly useful for addressing risks tied to conditions like drought or hail.

By offering financial stability, these insurance products help farmers mitigate the effects of weather-related crop losses, enabling them to focus on running their operations and planning ahead.

How can satellite imagery and soil moisture sensors help cotton farmers make better insurance decisions?

Satellite imagery and soil moisture sensors are game-changers for cotton farmers, offering real-time insights that make managing crops and insurance decisions much easier. With satellite imagery, farmers can regularly monitor crop health, spot drought stress, and detect potential damage. This frequent monitoring leads to more precise risk assessments and helps streamline insurance claims when needed.

Meanwhile, soil moisture sensors provide detailed data on how much water is in the soil. This information allows farmers to fine-tune their irrigation schedules, estimate yields more accurately, and evaluate drought risks. By leveraging these technologies, farmers can cut costs, ensure better insurance coverage, and make smarter choices for their crop insurance plans.