When it comes to managing risks in cotton farming, two federal crop insurance programs stand out: Cotton STAX and the Supplemental Coverage Option (SCO). Both programs offer protection against revenue losses based on county-level performance but differ in eligibility, coverage, and cost. Here's a quick breakdown:

- Cotton STAX: Designed for upland cotton growers, covering 90% to 70% of expected county revenue. It features an 80% federal subsidy and can be used as a standalone policy or combined with other insurance. Farms enrolled in ARC or PLC for seed cotton are not eligible.

- SCO: A supplemental policy available for farms enrolled in Price Loss Coverage (PLC). It covers revenue losses between 86% and the coverage level of your primary policy. The federal subsidy is 65%, and it requires an underlying crop insurance policy.

Quick Comparison

| Feature | Cotton STAX | SCO (Supplemental Coverage Option) |

|---|---|---|

| Eligibility | Upland cotton only; not for ARC/PLC-enrolled seed cotton | Requires PLC enrollment with an existing crop insurance policy |

| Coverage Band | 90%-70% of expected county revenue | 86% down to the primary policy level |

| Premium Subsidy | 80% | 65% |

| Usage Type | Standalone or combined with other policies | Supplemental endorsement only |

| Farm Program Impact | ARC/PLC enrollment for seed cotton disqualifies STAX | ARC enrollment disqualifies SCO |

Key Takeaways:

- Choose Cotton STAX if you want flexible, standalone coverage with lower out-of-pocket premiums and broader coverage bands.

- Choose SCO if you’re already enrolled in PLC and need supplemental protection for your existing crop insurance.

Both programs rely on county-level revenue data, so understanding your county’s yield history and risks is crucial. Consult your crop insurance agent for tailored advice and premium quotes.

What is Cotton STAX

The Stacked Income Protection Plan, or Cotton STAX, is a crop insurance program specifically designed for upland cotton growers. Unlike traditional crop insurance that focuses on individual farm losses, Cotton STAX takes a broader approach by offering county-level revenue protection. This program was introduced after cotton was removed from traditional commodity support programs in 2014, and it acts as a safety net for "shallow losses" - those revenue declines that fall between minor shortfalls and severe losses.

How Cotton STAX Coverage Works

Cotton STAX coverage is based on county-wide performance rather than individual farm results. Payments are triggered when the overall county revenue for cotton falls below the selected coverage level. Farmers can choose coverage levels ranging from 70% to 90% of expected revenue, with an adjustable protection factor between 80% and 120%, set in 1% increments. For instance, if you opt for 80% coverage and your county's revenue drops to 75% of expected revenue, Cotton STAX would pay out for the 5% gap.

A recent Texas farm survey found that combining Cotton STAX with an underlying revenue protection policy worked best for most Texas cotton operations.

The payment amount is calculated based on the difference between actual county revenue and the farmer’s chosen coverage level. This calculation uses yield and price data provided by the Risk Management Agency (RMA).

Who Can Use Cotton STAX

Cotton STAX is exclusively available to upland cotton producers. It does not cover Pima cotton or other cotton varieties. However, eligibility is tied to participation in other federal programs. Farms with seed cotton base acres enrolled in Agriculture Risk Coverage (ARC) or Price Loss Coverage (PLC) are not eligible for Cotton STAX on those acres. Essentially, producers must choose between ARC/PLC benefits and Cotton STAX coverage for seed cotton base acres.

If your farm does not have seed cotton base acres or you choose not to enroll those acres in ARC/PLC, you can participate in Cotton STAX. Importantly, enrollment in ARC/PLC for crops other than cotton does not affect your eligibility for Cotton STAX. This program is available in all U.S. counties where federal crop insurance for upland cotton is offered, making it accessible to producers across the country’s major cotton-growing regions.

Cotton STAX Costs and Subsidies

One of the key benefits of Cotton STAX is its affordability, thanks to an 80% federal premium subsidy. This means farmers only need to cover 20% of the premium, making it a cost-effective option for comprehensive coverage. Cotton STAX can be purchased as a standalone policy or combined with other insurance options, such as Yield Protection or Revenue Protection, for more extensive coverage.

The exact cost of the premium depends on factors like the county, the selected coverage level, and the chosen protection factor. To get an accurate quote and fully understand the costs and benefits, working with a crop insurance agent is highly recommended.

For more resources, visit cottongins.org to access a detailed list of local cotton gin services. In the next section, we’ll take a closer look at the Supplemental Coverage Option and how it compares to Cotton STAX.

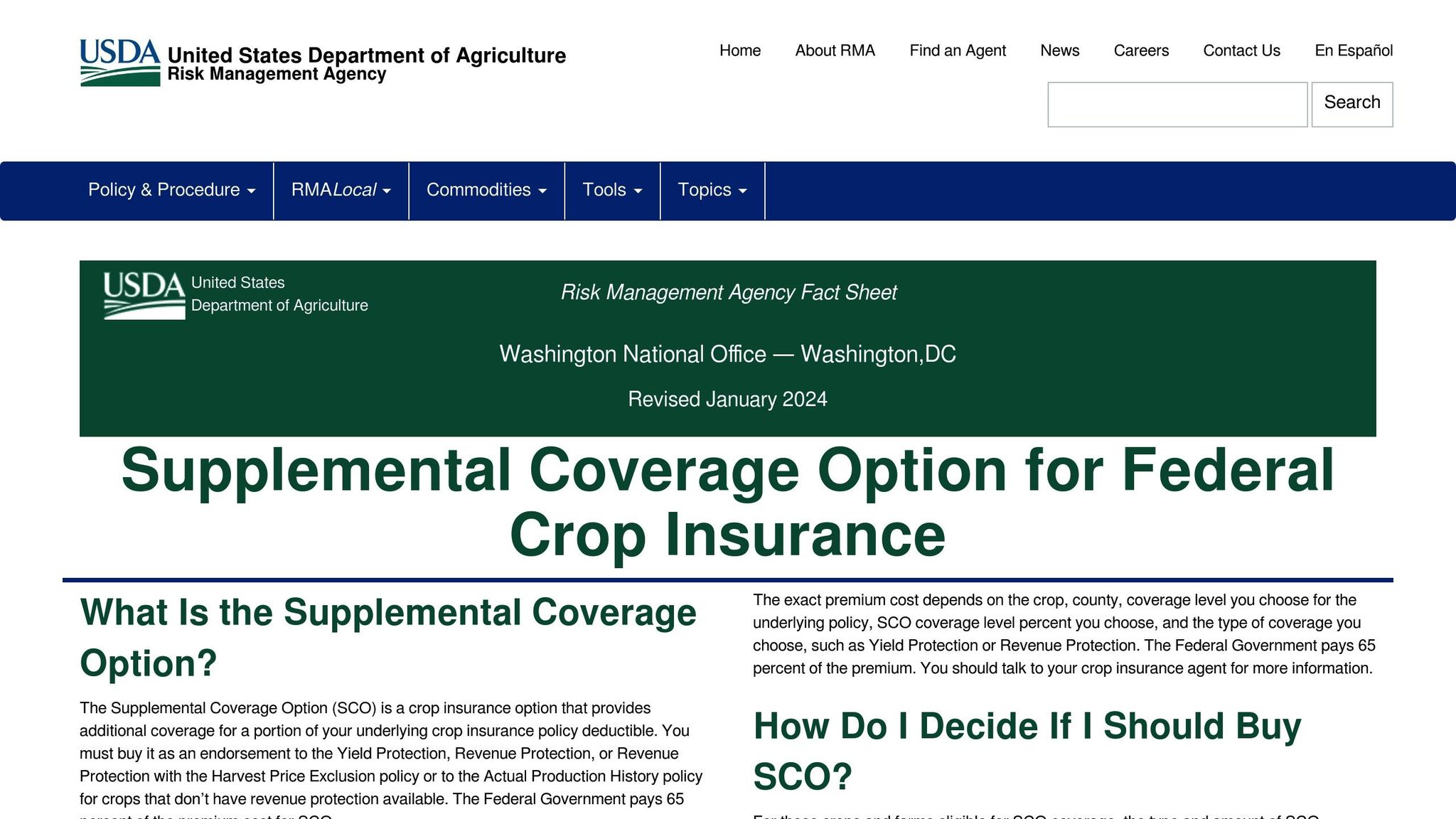

What is Supplemental Coverage Option (SCO)

The Supplemental Coverage Option (SCO) is a federal crop insurance endorsement designed to give cotton producers extra protection against smaller revenue losses. Rather than being a standalone policy, SCO acts as an additional layer of coverage that works alongside an existing crop insurance policy, such as Yield Protection or Revenue Protection. Essentially, it fills the gap between minor revenue losses and the coverage provided by your primary policy.

One key feature of SCO is that it operates on a county-wide basis. Payments are triggered by revenue losses at the county level, not based on individual farm performance. This program is specifically available to producers enrolled in the Price Loss Coverage (PLC) program, offering an added safety net when county revenues dip below expected levels but remain above your primary policy’s deductible. Let’s break down how SCO payments are calculated.

How SCO Coverage Works

SCO coverage kicks in when county revenue falls below 86% of expected levels. It pays for the difference between that 86% threshold and the coverage level of your primary policy.

Here’s an example: If your underlying Revenue Protection policy covers 70% of your crop and your county’s revenue drops to 80% of expected levels, SCO would cover the 6% gap (from 86% down to 80%).

The payment amount is determined using county yield histories and futures prices, similar to other area-based programs. Importantly, because SCO is tied to county-wide performance, you could receive a payment even if your individual farm doesn’t experience losses - so long as the county triggers the coverage. On the flip side, if your farm suffers losses but the county doesn’t meet the 86% trigger, no SCO payment will be issued.

Who Can Use SCO

To qualify for SCO, you must meet specific requirements. First, you need to be enrolled in the Price Loss Coverage (PLC) program and have an existing crop insurance policy. Farms participating in the Agriculture Risk Coverage (ARC) program are not eligible for SCO.

While Cotton STAX is limited to cotton, SCO applies to most program crops. However, you can’t combine SCO and STAX coverage on the same acreage. SCO is available in all counties where federal crop insurance is offered for cotton, making it widely accessible in major cotton-growing regions.

SCO Costs and Subsidies

One of the appealing aspects of SCO is its 65% federal premium subsidy. This means the government covers 65% of the premium cost, leaving you responsible for the remaining 35%. Although this subsidy is lower than Cotton STAX’s 80% subsidy, it still provides a cost-effective way to add extra coverage.

Your total insurance cost will include both the premium for your primary policy and the additional SCO endorsement. The exact premium rates depend on factors like your county’s risk profile, the coverage levels you select, and historical loss data. Generally, SCO premiums are higher than those for STAX, which could influence which program is the better fit for your operation.

To determine whether SCO aligns with your risk management goals, it’s best to consult your crop insurance agent for personalized premium quotes and advice.

For cotton producers looking for nearby resources, cottongins.org offers a directory of cotton gin locations across the United States, helping you find essential infrastructure in your area.

Cotton STAX vs SCO: Side-by-Side Comparison

When deciding between Cotton STAX and SCO, understanding the key differences can help you choose the program that best suits your needs. Here’s a breakdown of the main features and how they compare.

Feature Comparison Chart

| Feature | Cotton STAX | SCO (Supplemental Coverage Option) |

|---|---|---|

| Eligibility | Cotton only; not available for farms with seed cotton base enrolled in ARC/PLC | Farms enrolled in PLC with an underlying crop insurance policy |

| Coverage Band | 90% down to 70% of expected county revenue (in 5% increments) | 86% down to the individual policy coverage level |

| Premium Subsidy | 80% federal subsidy | 65% federal subsidy |

| Usage Type | Can be standalone or combined with other cotton insurance | Supplemental endorsement requiring an underlying policy |

| Protection Factor | Adjustable from 0.80 to 1.20 (up to 120% of expected revenue) | Not available |

| Farm Program Impact | ARC/PLC enrollment makes farm ineligible | Requires PLC enrollment |

| Payment Trigger | County-level revenue loss below the selected threshold | County-level revenue loss between 86% and the underlying policy level |

One of the most noticeable differences is the premium subsidy rate. Cotton STAX offers an 80% federal subsidy, meaning you only cover 20% of the premium cost. In contrast, SCO’s 65% subsidy leaves you responsible for 35% of the premium cost. This often makes STAX the more cost-effective option for producers.

These distinctions highlight how each program caters to different farming situations and risk management preferences.

Which Option to Choose

Your decision between STAX and SCO depends on your farm program enrollment status and your specific risk management goals. According to Texas surveys, STAX paired with a revenue policy tends to perform better than SCO.

Consider Cotton STAX if:

- You have little or no seed cotton base enrolled in farm programs.

- You want the flexibility of standalone coverage.

- Lower out-of-pocket premium costs are a priority.

- You prefer broader coverage bands (70% to 90%).

- You want the option to increase protection up to 120% of expected county revenue.

Consider SCO if:

- You are already enrolled in the PLC program.

- You need supplemental protection for your existing crop insurance policy.

- You are comfortable with a narrower coverage band (86% to your policy level).

- You are willing to pay higher premiums for an additional layer of protection.

It’s worth noting that both programs rely on county-level revenue data, which could lead to payments even if your farm performs well individually, as long as the county meets the loss threshold. On the flip side, you could experience losses without receiving payments if the county doesn’t trigger coverage.

Premium costs and expected payment frequency should weigh heavily in your decision. STAX generally has lower premium costs due to its higher subsidy rate and offers broader coverage bands, potentially leading to more frequent payments compared to SCO’s narrower protection range.

Before making a final decision, consult with your crop insurance agent. They can provide personalized premium quotes, analyze historical county yield data, and help you assess how county-level risks align with your farm’s specific needs.

For additional resources, cottongins.org offers a directory of U.S. cotton gins by county and state. This tool can be helpful when evaluating county-level risk factors that influence the effectiveness of both STAX and SCO programs.

sbb-itb-0e617ca

State and County Coverage Differences

Where you farm plays a big role in how Cotton STAX and SCO programs work for you. These programs depend on local conditions, state rules, and the availability of federal crop insurance for upland cotton.

Program availability hinges on whether your state offers federal crop insurance for upland cotton. STAX is only available in counties where this insurance is offered, while SCO applies to most program crops, including cotton, in states participating in the Price Loss Coverage (PLC) program. Farmers should confirm what’s available in their specific county to avoid surprises.

The effectiveness of these programs also ties closely to county yield histories. Payouts are based on county averages, meaning counties with lower yield histories tend to see more frequent payouts. On the other hand, counties with stable, high yields might rarely trigger payments, even if some individual farms experience losses.

Weather patterns add another layer of complexity. For instance, Texas - prone to drought - has seen frequent STAX payouts. However, in years with favorable weather, county averages may remain high, leaving some farmers without payments despite their own losses.

When it comes to premium costs, county-level risks like historical yield volatility and projected revenue play a big role. Counties with higher risks often have higher premiums, but the subsidy percentages remain the same across the board. This makes it critical to evaluate these costs on a state and county level to understand the true value of the programs.

For farmers managing multi-county operations, things get even more intricate. You might qualify for STAX in one county and SCO in another, depending on program enrollments and crop insurance coverage in each area. Coordinating with your insurance agent is key to ensuring appropriate coverage across all your locations.

A Texas farmer’s experience highlights how local factors shape decisions. Surveys of cotton farms in Texas found that STAX, paired with a revenue protection policy, was often the preferred choice due to local yield histories and premium costs. For example, a farmer in Lubbock County analyzed county yield data and determined STAX offered better protection against area-wide losses compared to SCO, particularly given the county’s history of yield variability.

Farmers can also turn to state extension services for location-specific advice. These services often provide tools, historical data, and recommendations tailored to local agricultural conditions, which can help refine program choices.

To make informed choices, farmers should request county-specific premium quotes from their insurance agents and review RMA county actuarial documents. These documents include county yield histories and expected yields, which are essential for estimating potential payouts. Partnering with local extension agents or crop insurance experts can further help align decisions with your farm’s unique risks and your county’s agricultural profile.

Finding Local Cotton Gin Resources

Local infrastructure, like cotton gins, plays a surprisingly important role when deciding on coverage. The website cottongins.org offers a directory of U.S. cotton gins, organized by county and state, covering major cotton-producing regions like Texas, Georgia, North Carolina, and Mississippi.

This directory is especially helpful when assessing county-level risks that affect STAX and SCO outcomes. Gin locations often reflect regional production patterns, yield histories, and market conditions. For example, areas with a high concentration of cotton gins usually indicate established production regions with more predictable yields, while counties with fewer gins might face more variable or emerging production conditions.

Local gins also provide networking opportunities. Gin operators and producers often share firsthand experiences with STAX and SCO, offering practical insights into how these programs have performed in the area. These conversations can add a layer of understanding to the raw data on county yields and risks.

The directory can also help farmers plan harvest logistics. Knowing where gins are located and their capacity can influence planting decisions and insurance choices, particularly when considering how county production levels might affect area-based insurance triggers.

Additionally, regional market intelligence flows through gin networks. Staying in touch with local gins can provide timely updates on coverage changes, program adjustments, and trends that might affect your insurance decisions for the next crop year.

For farmers with operations spanning multiple counties, the directory supports cross-regional comparisons. By showing gin density and infrastructure across regions, it complements RMA data, helping farmers evaluate how different counties might perform under area-based insurance programs. This is especially useful for those managing diversified operations across various locations.

Conclusion

Deciding between Cotton STAX and the Supplemental Coverage Option (SCO) comes down to your specific risk tolerance and enrollment status. STAX is designed for farms not enrolled in PLC/ARC for seed cotton, while SCO is limited to those participating in PLC and carrying an underlying crop insurance policy.

Here’s how they differ: STAX provides coverage ranging from 90% to 70% of expected county revenue, with adjustable protection factors. On the other hand, SCO kicks in when county revenue drops below 86%. The cost structure also varies - STAX benefits from an 80% federal subsidy, keeping out-of-pocket costs lower compared to SCO’s 65% subsidy.

According to farm surveys by the Cotton Economics Research Institute at Texas Tech University, combining STAX with an underlying revenue protection policy emerged as the most effective option for all surveyed Texas farms.

Both programs base payouts on county-level losses rather than individual farm outcomes, making it essential to consider local conditions and historical yield trends when deciding. Keep in mind, you cannot apply both STAX and SCO to the same cotton acreage - you’ll need to designate which acres fall under each program.

To make the best choice, evaluate your PLC/ARC enrollment status and consult with your crop insurance agent for tailored premium quotes and coverage scenarios. Reviewing historical county yield data and projected market prices can also help you estimate potential benefits.

For further resources, visit cottongins.org. This directory connects you with local cotton industry professionals and provides regional market insights to support informed decision-making. Ultimately, understanding your county’s yield history is essential to selecting the program that aligns with your farm's needs.

FAQs

What are the eligibility and enrollment differences between Cotton STAX and the Supplemental Coverage Option (SCO)?

Cotton STAX and the Supplemental Coverage Option (SCO) serve different purposes and cater to distinct groups of farmers. Cotton STAX is tailored exclusively for upland cotton producers, offering a specialized risk management tool. In contrast, SCO is open to a wider variety of crops, making it a more general option for farmers with diverse operations.

One key distinction is how these programs align with other insurance policies. Cotton STAX operates independently, meaning you don’t need to pair it with a base policy. On the other hand, SCO requires enrollment in a federal crop insurance policy, such as Revenue Protection (RP) or Yield Protection (YP), to be effective.

When choosing between these options, consider the unique needs of your farm and your overall approach to managing risk. For additional resources on cotton farming, directories like cottongins.org offer tools and insights specifically for cotton producers.

How do I decide between Cotton STAX and the Supplemental Coverage Option (SCO) for my cotton farm?

When weighing your options between Cotton STAX and the Supplemental Coverage Option (SCO), there are a few important points to keep in mind:

- Coverage Focus: Cotton STAX is tailored specifically for cotton producers, offering area-based revenue protection. On the other hand, SCO provides broader crop insurance that ties directly to your individual policy.

- Cost and Subsidy Considerations: Take a close look at the premium costs and subsidy levels for each program to see which aligns better with your budget and risk tolerance.

- Risk Management Preferences: Cotton STAX might be the right choice if you're looking for added protection against revenue losses at the county level. Meanwhile, SCO is designed to address risks tied to individual farm yields and losses.

To make the best decision, consider your farm’s specific needs, financial objectives, and exposure to risk. For additional resources or to find cotton gins near you, check out cottongins.org, which offers a detailed directory of U.S. cotton gins.

How does county-level revenue data influence the choice between Cotton STAX and SCO for my farm?

County-level revenue data is a key factor in evaluating how well Cotton STAX and the Supplemental Coverage Option (SCO) can work for your farm. Cotton STAX is designed specifically for cotton growers, using county revenue as a baseline to cover shallow losses that your main insurance policy doesn’t address. SCO, meanwhile, is linked to your individual crop insurance plan but also relies on county revenue to determine coverage.

By understanding revenue patterns and potential risks in your county, you can better decide which program fits your operation. If you’re seeking a cotton-specific solution, Cotton STAX might be the better fit. On the other hand, SCO provides broader coverage that complements your existing insurance. Taking the time to analyze local revenue data is crucial for making the best choice for your farm.